Online business owners or E-Commerce operators who are responsible for collecting Tax Collected at Source (TCS) under GST are also now required to register for GST, under a new regulation. Let us understand the important information relating to GST Registration for E-Commerce collecting TCS.

Understand about the GST TCS Regulations on E-Commerce

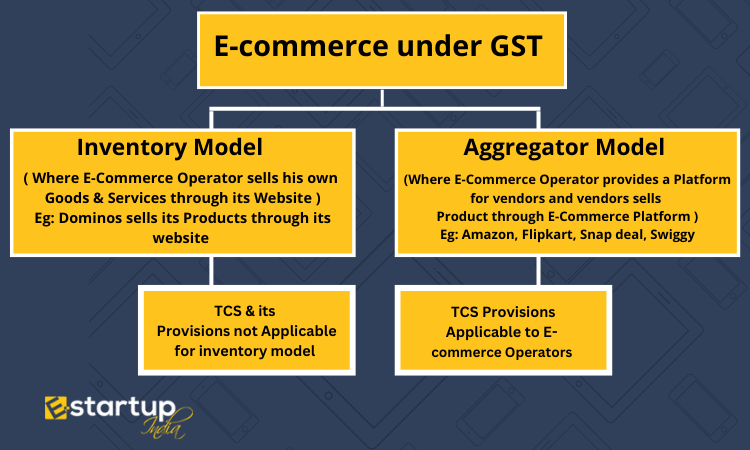

An entity that owns maintains, or manages a digital or electronic facility or platform for electronic commerce is referred to as an “electronic commerce operator” under the GST. E-commerce enterprises in India must thus adhere to the GST TCS rules.

If an e-commerce company collects tax on behalf of a provider of goods or services who makes supply via the operator’s online platform, the tax is known as Tax Collected at Source (TCS) under GST. TCS will be levied as a percentage of net taxable supply. CGST Act Section 52 deals with TCS provisions under GST. You can understand more about it at: GST Registration for E-Commerce.

Applicability of GST Registration for E-Commerce Collecting TCS

The obligation to collect and remit tax falls squarely on the shoulders of online aggregators under the Goods and Services Tax Act. Currently, TCS costs are calculated at a rate of 1% per transaction. As soon as the duty is collected and credited, the online brokers of goods and businesses will receive their payment.

Thus, every online retailer offering products or services must have GST regardless of their annual revenue to participate in the Tax Collected Source. However, service providers who do not use an electronic trading platform and whose annual revenue does not exceed Rs. 20 lakhs are not required to register for GST. Thus, if you are required to have GST for your e-commerce business and also need to maintain your books easily, you can utilize best Accounting for E-Commerce Business in India.

Can an E-commerce collecting TCS cancel GST Registration?

When a taxpayer is no longer required to submit tax payments or make tax deductions, the appropriate officer will verify this information and cancel the taxpayer’s registration online using Form GST REG-08 and following the process of GST cancellation.

What is the process to get GST Registration for E-Commerce collecting TCS?

- Fill out GST REG-07 electronically using the GST Portal.

- Fill it with the required details and correctly sign it using EVC or Digital Signature Certificate.

- Complete the form and submit it.

- The appropriate officer will provide a GST registration certificate.

Document Requirement to get GST Registration for E-Commerce Collecting TCS in India

- Company’s PAN card

- Certificate of Incorporation issued by Ministry of Corporate Affairs (MCA)

- Articles of association/Memorandum of association

- Authorized signatory’s Aadhar card and PAN card details

- Proof of address and PAN card details of company directors

- TCS Details

For the detailed document requirement and to apply for GST Registration, you can contact our GST Professionals at: info@e-startupindia.com. Also read our guide:

How to get GST Registration if I am starting a new online business

Behind the fuss about GST on essential items: Two sides of the same coin

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.