The activities under Ease of Doing Business and Reducing Compliance Burden, which are intended to create a favorable business environment, are being led by the Department for Promotion of Industry and Internal Trade (DPIIT). These various initiatives are taken to boost the MSME Sector which are India’s major contributor to GDP growth and also provider of employment to masses. This article will discuss the important initiatives taken to create a conducive business environment.

What is MSME?

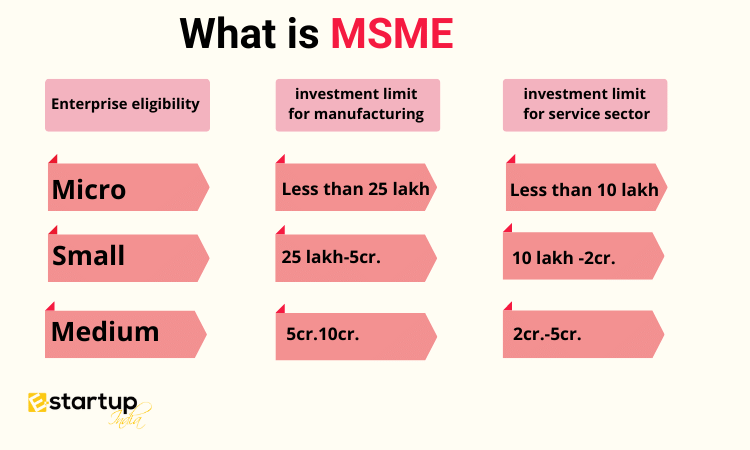

The MSMED Act of 2006 serves as the foundation for the current MSMEs defining criteria. For the production and service units, it was different. Initially, the definition of MSME was different. The economy has changed significantly since then. As per the latest definition, MSME is Micro, Small Medium Enterprise

| Size of the Enterprise | Investment and Annual Turnover |

| Micro | Investment less than Rs. 1 crore Turnover less than Rs. 5 crore |

| Small | Investment less than Rs. 10 crore Turnover up to Rs. 50 crore |

| Medium | Investment less than Rs. 20 crore Turnover up to Rs. 100 crore |

Importance of MSMEs in India

- Firstly, MSMEs are renowned for giving fair support for increased company access to both local and international markets.

- MSMEs are important for product creation, design innovation, intervention, and packaging.

- MSMEs promote the modernisation of this industry’s infrastructure, technology, and other factors.

- Similarly, MSMEs offer financing and job possibilities.

- MSMEs give credit limits or financing support to the country’s banks.

- Compared to the major enterprises in cities, they have contributed to the industrialisation of underdeveloped areas with a minimal capital cost.

- MSME Department also provides various beneficial schemes to businesses such as MSME sustainable certification scheme.

- MSMEs have also made a significant impact and contributed to the growth of the nation in a variety of ways, including the need for minimal investment, operational flexibility, a low rate of imports, and a significant amount of domestic output.

Various Initiatives to create a conducive business environment

Udyam Portal Launched

Udyam Portal Launched

A fully online, paperless, and transparent MSME registration procedure is provided via the Udyam Registration (UR) Portal. For the registration of MSMEs, no supporting documentation or evidence must be supplied. For registration, only the Aadhaar number and PAN Card are required. Information on investments and turnover of businesses that is connected to a PAN and the Goods & Services Tax (GST) is automatically retrieved from government databases.

Introduction of Digital Payments and MSME Sambandh Portal

Introduction of Digital Payments and MSME Sambandh Portal

- Digital Payments have been created in order to distribute the advantages of the Ministry of MSME’s initiatives via digital payment gateway.

- The MSME SAMBANDH Portal was created to aid in monitoring how the Public Procurement Policy is being implemented for micro and small businesses.

- The MSME SAMADHAN Portal is created to assist micro and small business owners nationwide in registering their grievances involving delayed payments.

- The CHAMPIONS Portal is created to expedite the resolution of complaints.

- The Government e-Marketplace (GeM) has been instructed to make it even easier for MSMEs to conduct online business with various government departments, organizations, and CPSEs.

Moreover, if you require any kind of guidance related to the MSME Registration online , please feel free to contact our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates reciting to your business.