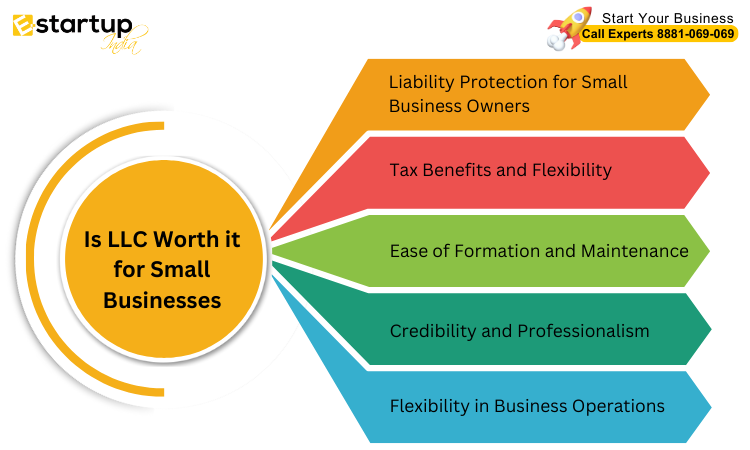

Just go and ask a business owner about how many decisions and opinions they are surrounded by in their daily life if you are concerned about complexities in your life. This is because they have to make many decisions while starting a business and deciding on the right business structure is a crucial one. And, when it comes to small business owners, we promote going for LLC Company Registration in the USA. This can be worthy in many ways or maybe not as well.

So, here we have come up with some points to clear all your doubts about your small business and whether it’s the right fit for you or not.

-

Liability Protection for Small Business Owners

Small business owners should consider LLC Company Registration due to the level of protection it provides for personal assets. This is because your personal and business liabilities are not separated while operating as a sole proprietorship. So, you may end up losing your personal assets if your business runs into debt or legal trouble.

Eventually, you set kind of a boundary between your personal and business finances when you choose it for your small business. This is the actual liability protection a business owner needs that those sole proprietorships simply cannot provide.

-

Tax Benefits and Flexibility

You will for sure be getting tax benefits if you opt for LLC Company Registration as it allows you to pass through your business profits and losses under your personal income tax return. So, you will better be able to avoid double taxation by doing so.

You can also choose if you want to be taxed as a sole proprietorship, partnership, or even a corporation. This is how businesses should legally optimize their tax.

Learn More: Tax Benefits to Form LLC Company Registration in USA

-

Ease of Formation and Maintenance

Forming it is simpler than assumed as compared to other business entities. You just have to file the articles of organization with your state’s Secretary of State and pay the registration fees. You may have to appoint a registered agent and after that, you will have to create an operating agreement. This will shape your business management.

There are fewer formalities in it as compared to a corporation as you don’t need annual shareholder meetings or extensive reporting. And this simplicity will save you a lot of time and stress.

-

Credibility and Professionalism

It surely enhances credibility due to the professional appearance your business gets in front of potential clients. What makes a company trustworthy is it’s professional a business name and a proper structure.

Expertise and quality services matters but what matters the most is how you represent your company in front of the clients. This helps secure big clients as well as loans if needed.

-

Flexibility in Business Operations

Obviously, you will get taxation benefits, but more than that, it provides flexibility to your business. So, no matter if you’re the sole owner or have multiple partners, you can structure it accordingly. That’s why many small businesses go for LLC registration instead of other types of businesses.

Is an LLC Right for Your Small Business?

Even after having so many benefits, this may not be suitable for your business. This is just a statement and not a final announcement about your business needs. So, what we suggest is to choose according to your needs and perspective.

A small business that doesn’t want to dive into complexities may run a business better as a sole proprietor but the one who understands the benefits will definitely go for the LLC company registration.

If you want any other guidance relating to the LLC Company Registration please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.