In a relief to taxpayers, the government on Wednesday extended compliance deadlines for income tax, goods and services Tax Vivad se Vishwas direct tax dispute resolution scheme and GST annual Return in view of the challenges arising due to the COVID-19 pandemic. In this article, we will discuss the due date extended For ITR, Vivad se vishwas & GST Annual Return

Why Due Date Extended for ITR, Vivad se Vishwas & GST Annual Return

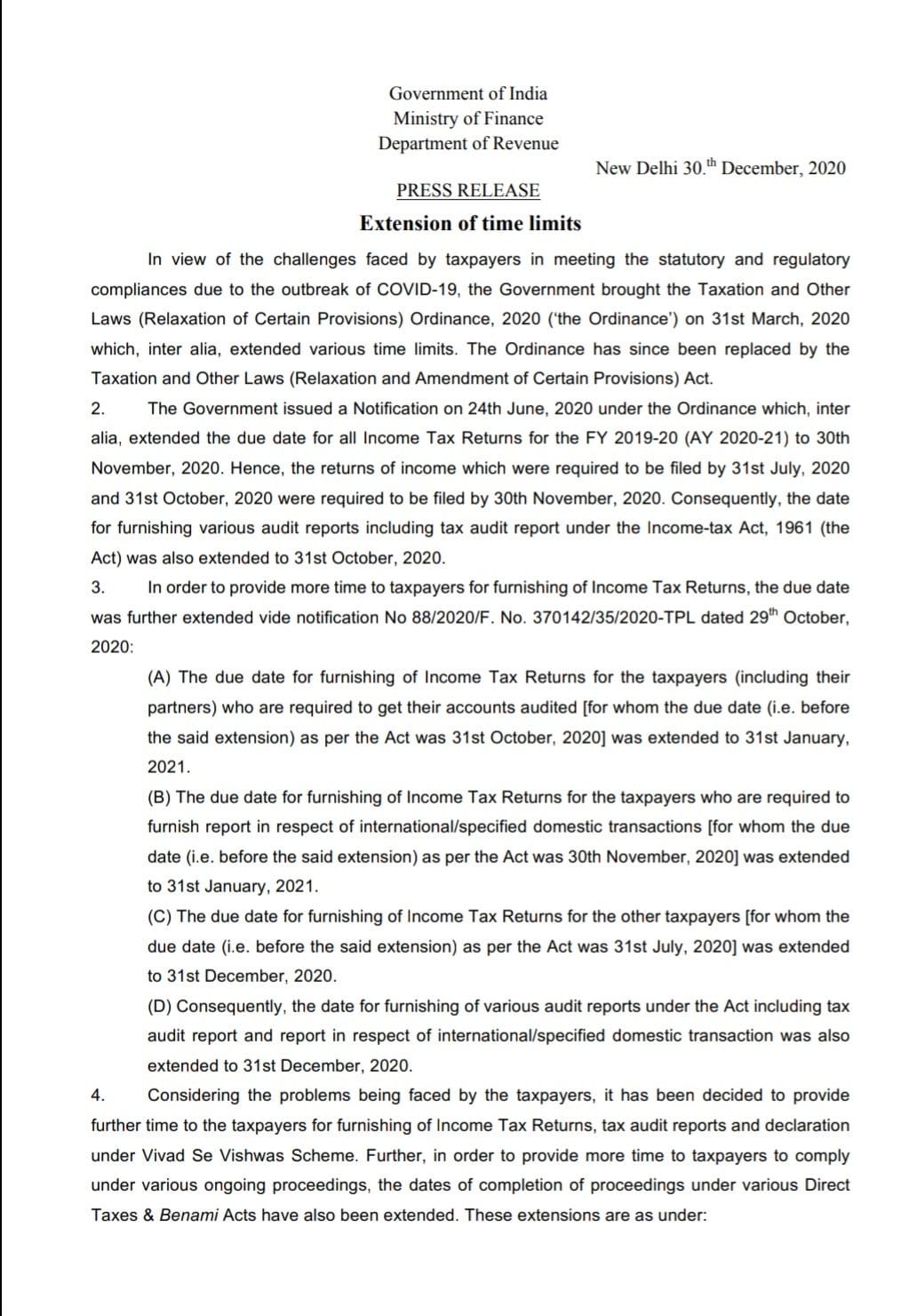

Considering the problems being faced by the taxpayers, it has been enacted to provide further time to the taxpayers to comply (extended due dates),” the government said in an official release.

The Income Tax Department inscribed in a tweet “In view of the continued challenges faced by taxpayers in meeting statutory compliances due to outbreak of COVID-19, the Govt further expands the dates for various compliances.” Here’s the official notification:

Due Date Extended for ITR Filing

The government has extended the deadline for ITR Filing for FY 2019-20 for most individuals from the current deadline of December 31, 2020, to January 10, 2021. The extension of the deadline is for those individuals whose accounts are not compelled to be audited and who usually file their ITR-1 or ITR-4 forms. Also, this is the third time that the government has extended the deadline for ITR filing. Check the previous due date for ITR Filing.

Further, the deadline for other taxpayers such as companies whose accounts are compelled to be audited (including partners of a firm) and/or those who have to submit a report in regard to international financial transactions has been extended to February 15, 2021.

Due Date Extended for Vivad se Vishwas Tax Dispute Scheme

In order to furnish further relief to the taxpayers desirous of settling disputes under Vivad se Vishwas Scheme, the Government has further extended the date for making payment without extra amount from the government has also extended the declaration window under Vivad Se Vishwas Scheme by a month to January 31, 2021. Know previous due date for Vivad Se Vishwas Scheme

Note- The Income-tax Department on Wednesday confessed that more than 45.4 million tax returns for 2019-20 fiscal have been filed till December 29.

Due Date Extented for GST Annual Return Filing

The Finance Ministry has expanded the last date for GST Return filing for FY20 to February 28, 2021, Earlier, the due date was December 31. There have been needing to extend the date for two reasons: first, the pandemic and second, the due date for annual returns for FY19 is December 31. Although, there are primarily two annual returns GSTR 9 and 9C. GSTR-9 is the annual return to be filed by every GST registered taxpayer irrespective of their turnover. Know previous due date for GST Annual Return Filing.

In case, you need any kind of guidance related to the GST Registration, GST Return Filing, and ITR Filing please feel free to contact our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates relating to your business.