GST or Goods and Services Tax is an indirect taxation system in India. With the motive of One Nation and One Tax, GST has become widely popular and applicable across our nation. However, similar to the two sides of a coin, GST has both Advantages and Disadvantages. It is essential for every entrepreneur to know about the Advantages and Disadvantages of GST. Therefore, In this article, we will know about Advantages and Disadvantages of GST.

What is GST?

GST stands for Goods and Services Tax. It was launched in India in 2017 with several motives. Some of the main purposes of GST implementation was to:

- Reduce Cascading Effect of Taxes

- Promote Online Transactions and Online Return Filing

- Support MSMEs

- Curb the Tax Evasion

- Bring more businesses under taxation

- Boost Competitive Prices and Increase the consumption of Goods and Services

- Implement Online Procedures to streamline logistics and make it easy to conduct business.

Thus, The government levies GST on the supply of goods and services. In GST, the consumer of the goods and services has to pay indirect taxes, and then the supplier has to submit it online to the government.

It is an indirect and single tax for the whole nation. However, there is also an important concept of CGST, SGST, and IGST. You can understand about it in detail at – Guide to GST

What is GST Registration?

GST Registration is simply an application form to register under GST. Every business as per the eligibility criteria has to get GST Registration and then submit taxes through GST Return Filing.

What are the advantages and disadvantages of GST?

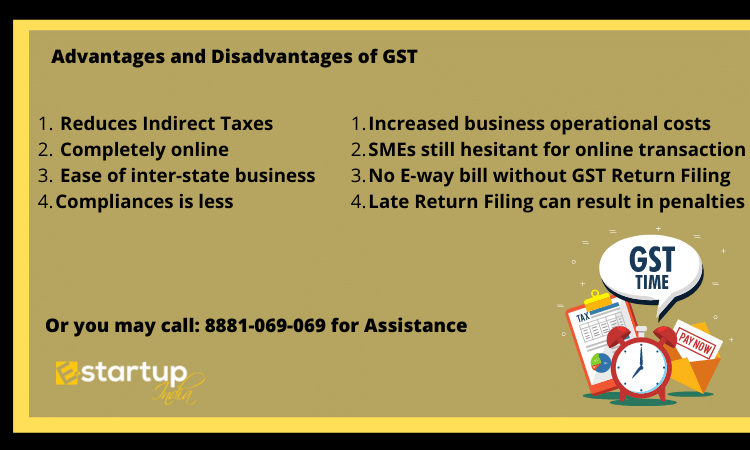

The advantages and disadvantages of GST are listed below:

| Advantages of GST | Disadvantages of GST |

| GST reduces the number of Indirect Taxes. | The GST has increased the business operational costs. |

| The GST Registration is completely online. | Many SMEs are still hesitant to do online transactions and pay taxes online. |

| The number of GST Compliances is less so you don’t have to invest a lot of time for GST Return Filing. | Late GST Return Filing can result in penalties. You can use Tax Panchang to remind yourself of the due dates of all the tax compliances. |

| Ease of doing inter-state business using e-commerce operators after getting GST Registration in India. | The GST Regime is strict and without filing a GST Return you can not generate e-way bills. Thus, you can not transport your products inter-state without enrolling under GST and filing returns on time. |

| GST has regularized unorganized business sectors in India through online procedures. | Multiple businesses find it cumbersome to maintain online records, generate invoices, etc. However, businesses can use InstaBill – GST Billing, eInvoice & Accounting App for smooth online procedures under GST. |

| It provides a single GSTIN that can be used for all the aspects of GST. | It is still difficult for businesses in remote areas to enroll under GST. |

| It offers a composition scheme to pay taxes at a fixed rate and reduce the tax liability and tax rates. | It has increased the burden of compliances. |

| The threshold limit of GST Registration is quite high i.e. Rs. forty lakhs annual turnover or Rs. twenty lakhs annual turnover for special states under GST. | |

| You can claim Input Tax Credit easily after fulfilling the compliances. | |

| It is easy to detect tax evasion under GST Registration. |

Procedure to register GST

- Login on GST Registration – E-Startup India and provide the required documents. You can also contact us for understanding the document requirement or seek guidance for document preparation of GST Registration.

- Choose a package and pay online with different payment modes available.

- After the correct inspection of documents and understanding your eligibility, One of our dedicated professionals will file the required GST application form.

- After the successful approval from the Government Department, you will get your GST Registration Certificate, a unique GSTIN, and GST Invoicing Software from us.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.