If your tax payment exceeds the amount that was liable during the assessment year, then the government refunds the amount. It is known as Income Tax Refund and you can avail of it through a refund application to the income tax authorities. Besides, You can check the status of your income tax refund 10 days after your income tax return filing. In this article, you will understand the complete procedure to check income tax refund status.

How to check the ITR refund status?

If you get a notice from the income tax department, you can check the status of the ITR refund. To check the refund status, you can visit the official website of NSDL or you can visit the e-filing portal of income tax.

Income Tax Refund Explained

The Income Tax Refund appears in the highlighted form along with the date of refund and the mode of refund whether credit to the bank account or ECS etc.

If the payment is not credited, then you can get an update such as ‘processed’ which means it is verified by the Income-tax department and they will determine the amount to be refunded.

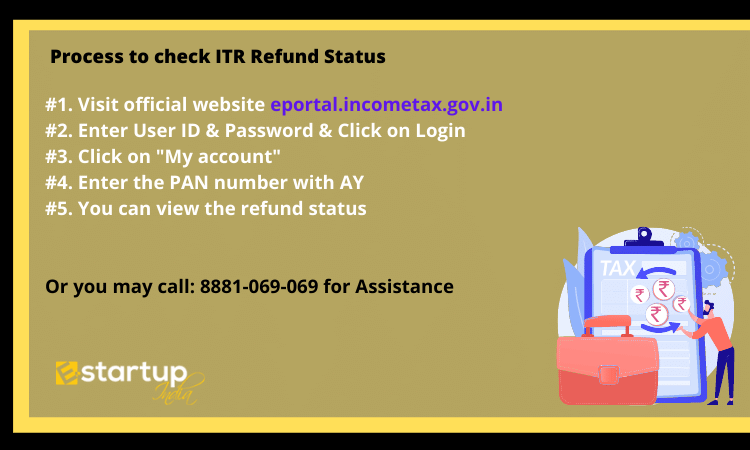

Check ITR Refund Status through the E-filing portal

The steps are written below:

- Visit official website eportal.incometax.gov.in

- Enter login Id & password, then enter the captcha.

- Then press ‘Login’.

- Click on the ‘My account’ option.

- Enter your PAN number and choose the Income-tax returns option.e

- Enter assessment year and press Submit.

- Then you can view details such as A.Y, ITR form, Income tax return filing Etc.

- Then you can view the status of the income tax refund.

Different Types of Income Refund

If you visit any of the two official websites for checking refund status, you can also receive the following statuses.

Refund unpaid

If your tax refund is approved by the IT department, but yet it is not credited to your account then the portal shows status as ‘Refund unpaid.

Refund determined and sent to Refund banker

Your refund is sanctioned by the IT department and it is sent to the Refund banker who will shortly remit the amount.

Refund not determined

When your IT refund is yet not processed and hence it shows this status. So, you can check the refund status later on.

No demand No refund

This status means that you have not filed for an income tax refund.

Refund Determined

The income tax department has calculated your IT refund amount but your records do not tally with the tax refund as determined by the IT department.

Rectification processed

Your rectification return has been approved by the IT department, but you should pay some amount of taxes within a specified time. You also may be notified that you need not pay taxes nor are you eligible to receive a tax refund.

Check Income tax refund status on NSDL

- Visit the official website of NSDL.

- Enter your PAN number and the AY.

- Enter the Captcha to validate it.

- Then you can view the status of your income tax refund.

- If the amount is credited to your bank account, then they mention it along with the mode of payment.

Conclusion

To view the income tax refund, you can visit the official website of the e-filing portal or NSDL. If your refund is not approved, the reason is clearly stated and hence you can undertake further action.

Moreover, If you want any other guidance relating to ITR Filling, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.