A massive relaxation for LLPs as LLP annual return form-11 due date is extended. LLP annual return form-11 is an important return that LLPs must file every year. The announcement of due date extension without paying an additional fee brings an opportunity for every business having LLP Registration to be compliant with laws and avoid hefty penalties. This article discusses the latest updates as LLP annual return form-11 due date is extended.

What is LLP Annual Return Form-11?

LLP Annual Return Form-11 is basic annual return that businesses having LLP Registration need to mandatorily file. The annual return form-11 is also compulsory to file even if the firm doesn’t operate or carry out any business during the financial year.

The purpose of filing the Form 11 is to prepare the annual return, which is duly verified by the RoL (Registrar of LLPs ) within 60 days of the end of the financial year.

Required Information and Documents to file Annual Return Form 11

- LLP Identification Number

- Name of the Firm

- Registered office address

- Business Classification of the LLP (Business, Profession, Service, Occupation, Others)

- Principal business activities of the LLP

- Details of Designated Partners and Partners

- Total obligation of the contribution of partners

- Total contribution received by all partners

- Summary of Designated Partners and Partners

- Particular penalties imposed on the LLP, if any

- Particulars of compounding offenses, if any

- Details of LLP and or company in which Partner/Designated Partner is a Director/Partner (It is mandatory to attach this detail in case any Partner/Designated Partner is a partner in any LLP and/or Director in any company)

Important things to know about LLP Annual Return Form-11

- You need to have a Digital Signature Certificate of designated partners to sign the LLP Annual Return Form-11.

- Form 4 (Notice of appointment, cessation and change in designation of a designated partner or partner) should be paid for and processed as soon as possible before filing LLP Annual Return Form-11.

- You must have LLPIN (Limited Liability Partnership Identification number) handy.

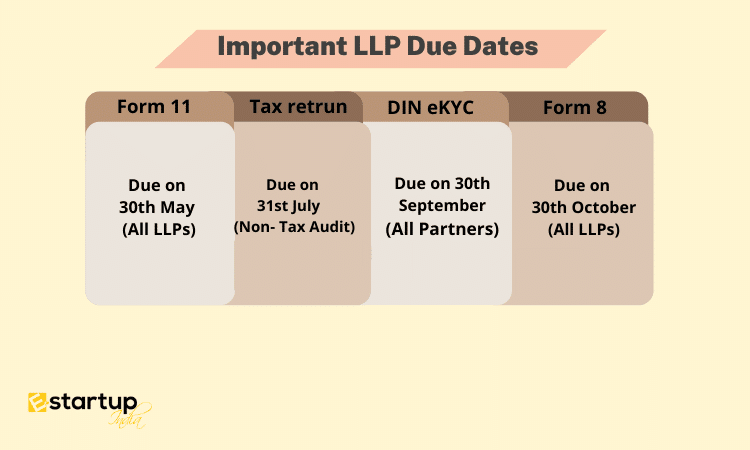

- Within 60 days after the end of the financial year, LLP Form 11 must be filed. Since the end of the fiscal year for all LLPs occurs on March 31st, the LLP Annual Return Form 11 is due on May 31st of each year.

- When LLP Form 11 Annual Return is not filed by 31st May, a penalty of Rs.100 per day will be imposed till the noncompliance is resolved.

- Due to a lack of a cap on the penalties, it will keep on growing over time.

- Thus, submitting the annual return FORM-11 on time is critical in order to avoid paying a high fine.

Latest Updates: MCA Extends LLP Form-11 Due Date till 30th June 2022

A circular issued states that “This Ministry has received representation seeking an extension on timelines for filing the Annual Return (Form 11) by LLPs without paying additional fees. In view of the transition from version-2 of MCA-21 to version-3 and to promote compliance on part of LLPs, it has been decided to allow LLPs to file e-Form 11 (Annual Return of Limited Liability Partnership) for the Financial Year 2021-2022 without paying additional fees up to 30th June 2022.”

Source: MCA Notification

Conclusion

In conclusion, the news about LLP Annual Return Form-11 due date extended is a major relief for businesses. LLP Registered businesses must grab this beneficial opportunity at the earliest and avoid last minute stress along with hefty penalties.

If you need any further assistance for LLP Annual Compliances, E-StartupIndia is here to serve you in a simple stepwise process. Contact us at – 8881-069-069 or info@e-startupindia.com to know more.