The Government has released a new and strict tax regime for the corporations in India. As per the latest notification, MCA increased additional fees on Forms for late filing. Now the delay in compliance can cost you a hefty amount. Hence, it is the right time to file all the pending forms and arrange the resources for future company forms filing on time.

The new notification will have an impact on every business whether large or small. In this article, we will understand the latest notification from MCA on the increase of Additional fees on Forms for Late filing.

Latest Notification: MCA increased additional fees on forms for late filing

The MCA(Ministry of Corporate Affairs) has launched a new notification dated 11th January 2022.

Existing additional fees on late filing of forms were 12 times. However, with the effect of this notification, the additional is now increased 6 times more than initial late fees.

As a result, the additional fees on late filing now will be up to 18 times the normal fees. The increase in additional fees will be applicable from 1st July 2022.

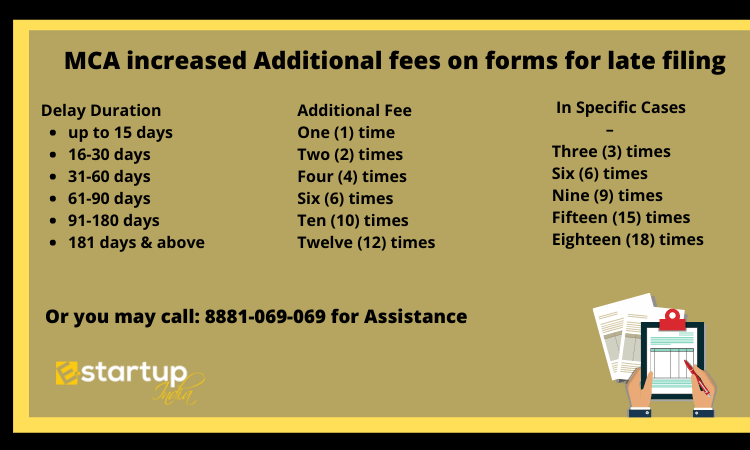

You can understand the applicable late or additional fees on forms from the table given below.

| Delay Duration for Filing Forms | Additional Fee | Higher Additional Fees in specific cases |

| up to 15 days (Forms u/s 139 and 157) | One (1) time | – |

| 16-30 days (Forms u/s 139 and 157) and up to 30 days (remaining forms) | Two (2) times | Three (3) times |

| 31-60 days | Four (4) times | Six (6) times |

| 61-90 days | Six (6) times | Nine (9) times |

| 91-180 days | Ten (10) times | Fifteen (15) times |

| 181 days and above | Twelve (12) times | Eighteen (18) times |

Understand the Applicability of Increased Additional Fees

- It is important to note that this hike in additional fees is not effective immediately and will come into effect on and from 1st July 2022.

- Additional fees on forms will be increased to 18 times the standard rates, up from the current 12 times. In addition, when a higher additional fee is due, no additional fee will be levied.

- The additional fees will be levied on a variety of forms including Form INC-22A or e-form PAS-3.

- If there is a delay in submitting e-form INC-22 or e-form PAS-3 on two or more instances within a duration of 365 days from the date of filing the previous such delayed e-form where an extra fee or higher additional fee was charged, higher additional fees will be payable.

- Except for increases in nominal share capital or u/s 92 (Forms for Annual Return, Financial Statements) or u/s 137 (Forms for Filing Charges), where the standard fee and an increased fee of Rs. 100 per day of delay without cap limit will apply in certain situations for late filing of forms.

- MCA has stated that the above-mentioned fees (Addition in fees and Higher Additional fee) would not apply if the following forms are not filed on time:

- SH-7: Increase in Nominal Share Capital Form

- AOC-4: AOC-4 is a form that is filed under Section 137 of the Act.

- MGT-7: Form submitted in accordance with section 92 of the Act.

- Charges Form (CHG-1, CHG-4, etc.)

If you want any other guidance relating to the company annual compliance, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.