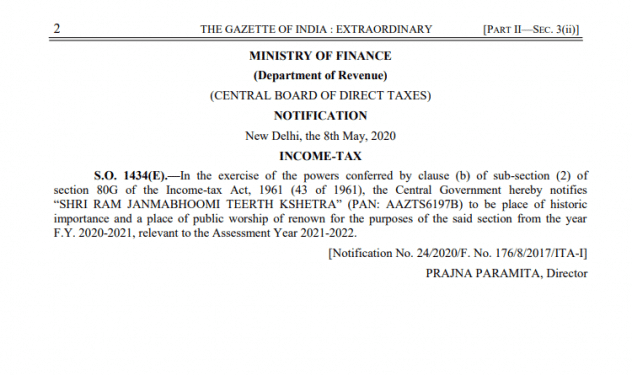

The Tax department has announced on 8th May 2020 that Shri Ram Janambhoomi Teerth Kshetra Trust has been placed under section 80G of the Income-tax Act 1961. With that, any donation made to the Ram Janambhoomi Teerth Kshetra Trust will be totally tax-exempted under the provisions of section 80G of the Income Tax Act for the FY 2020-21.

Why is Ram Janambhoomi Teerth Kshetra Trust put u/s 80G?

The Central Board of Direct Taxes (CBDT) has announced that donations made to Ram Janambhoomi Teerth Kshetra Trust are now eligible for tax exemption u/s 80 G of the Income Tax Act, on the grounds that the said structure (i.e. Ram Mandir) would be— “a site of historical significance and a place for public worship”.

Have a look at the CBDT Notification:-

Now, let us understand the concept of Section 80G Tax exemption

Brief Overview of section 80G of the Income Tax Act

Section 80G is the new provision under the Income Tax Act 1961. It provides a 50% exemption from paying the Income-tax on donation to a charitable trust. A person is eligible to claim this exemption only if he makes a donation under any of the specified Government funds. The individual can easily claim his/her donated amount while the income tax return filing. Now, all the donations made to the Ram Janambhoomi Teerth Kshetra Trust are eligible for tax exemption u/s 80 G of the Income Tax Act.

The benefit of 80G Exemption

Many charitable trust and NGOs, which are involved in philanthropic works, fall u/s 80G. Hence, the taxpayers can claim tax exemption on the donation made to any one of them. They can simply claim a deduction of 50% of their income tax paid.

A brief overview of the Ram Janambhoomi Teerth Kshetra

On 9th November 2019, the Supreme Court’s verdict had settled the Ram Janambhoomi-Babri Masjid case. Subsequently, Shri Ram Janambhoomi Teerth Kshetra Trust was formed with the intent of the construction of the proposed Ram Mandir in Ayodhya. This is a 15-member trust which is formed under the leadership of our Honourable PM Sh Narendra Modi.

Download E-Startup Mobile App and Never miss the latest updates relating to your business.

Wow, awesome blog layout! How long have you ever been blogging? you made running a blog look easy. The full look of your website is fantastic.