Since the beginning of the Indian Constitution, the earlier in-direct taxation system had faced a shock because of the imposition of multiple taxes before the introduction of GST with Types of GST Return. The traditional multilayer taxation scheme created a scenario of a double taxation system. Along with its cascading effects, it ultimately led to an equal distribution of revenues between the two-tier system of government. In this article, we will discuss Types of GST Return and how to apply for GST Registration in India.

Comprehend (Goods and service tax) GST Registration

The concept of GST is introduced based on “one nation one tax” which is intended to merge multiple tiers of taxes into one unified tax known as GST (Goods and Service tax).

Before GST there were multiple sets of tax slabs such as (excise duty, VAT, services tax). It is levied on the supply of goods and services, whether interstate or intrastate which creates a burden on the Indian Economy. Hence govt. approved this Goods and Service Tax Act in Parliament on 29th March 2017 which came into effect on 1st July 2017.

What is in the new GST Framework?

The GST incorporates two Types of GST Return in India. One is interstate (supply of goods between multiple states) and intrastate (supply of goods within the state).

At the intrastate level, two GST taxes will be levied in the form of CGST(Central Goods and Service Tax) + SGST (State Goods and Service Tax).

- On the supply of goods within the state, a seller has to collect both CGST and SGST from the buyer. The tax share under CGST will get deposited with the central govt. The same as a share of tax under SGST is meant with the state Govt.

At the interstate level tax shall be levied in the form of IGST (Integrated Goods and Service tax).

- On the supply of goods and services between states, the IGST tax acts as an independent tax, which is levied in both cases of import and export between the states.

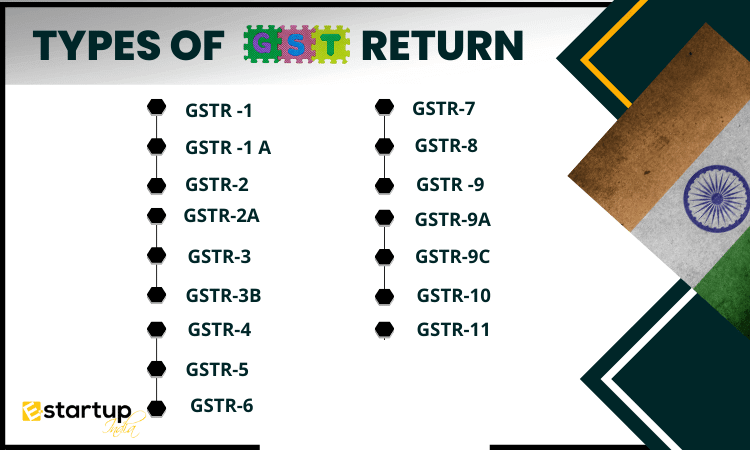

Types of GST Return

A GST return is a document that shows the GSTIN number that a user may have registered, along with the details of sales/expenses/purchase of a taxpayer, which is also reviewed by tax authorities to calculate net tax liability.

GSTR – 1

GSTR – 1

GSTR-1 is a document that includes reporting details of all outward supplies of goods and services for eg –

- Any sales transactions made during a tax period,

- Any changes to invoices

- Whether the movement of goods should be reported in GSTR-1.

A normal taxpayer who is registered under GSTR can file this GSTR-1 every month, moreover, except in the case of small taxpayers whose turnover is up to Rs 1.5 crore.

GSTR -1 A

GSTR -1 A

A normal taxpayer registered under GST can file GSTR 1A. It will help to rectify the mismatch figure in the given invoice issued to your customer, based on the GSTR-1 return due date.

Any regular Taxpayer with having 15 digit GSTIN number can file GSTR 1A. On the exception that a person should not be a UIN number holder. The aggregate business turnover should not exceed 20 lakh Rupees.

GSTR-2

GSTR-2

GSTR-2 comprises the details of all inward supplies of goods and services including purchases and Imports made from registered suppliers during a tax period on the 15th of every month.

A person should be a regular taxpayer registered under GST having a GSTIN number, but on the condition that a user must not be a composition vendor.

GSTR-2A

GSTR-2A

The purpose to file this return is to rectify or resolve a mismatched figure in an invoice that you have received from a vendor. It is a purchase-related tax return that generates for each business separately. If a taxpayer files for GSTR 1 then information of the latter one will automatically be stored in GSTR 2A.

GSTR-3

GSTR-3

GSTR-3 is also known as the final monthly return, comprising summarizing details of tax levied on sales of goods and services. Moreover, the input tax credit is claimed also on purchases.

A regular taxpayer who is registered under GST has a GSTIN number. It is mandatory for a taxpayer to file GSTR 1 and 2 to file GSTR 3.

GSTR-3B

GSTR-3B

A regular taxpayer is mandatory to file GSTR 3B even with no business transaction within a given tax period. It is a monthly self-declaration that must be filed by GST registered taxpayer along with the GSTR-1 and GSTR-2.

GSTR-4

GSTR-4

It is a tax return that provides a relaxation for a composition scheme holder to pay a tax return only “once”, also on the same hand, a taxpayer without a composition scheme needs to furnish 3 months return by 30th April.

GSTR-5

GSTR-5

This type of tax return needs to be filed by a non-resident foreign taxpayer who carried out their business transaction within India by the tax facilitation center.

GSTR-6

GSTR-6

This type of tax return needs to be filed by those who are registered as ISD. A regular taxpayer needs to file this tax return every month, whether there is no business activity or a nil business return.

GSTR-7

GSTR-7

This type of GST return incorporates the details of TDS deduction, this GST return is filed by those taxpayers who are likely to deduct TDS on the same hand TDS liability is payable and the refund can be claimed.

GSTR-8

GSTR-8

The e-commerce companies indulged in collecting TCs can file this type of GST return. A user needs to show the list of goods supplied from an e-commerce platform along with TCS.

The filing of GSTR is due on the 10th of the following month.

GSTR -9

GSTR -9

It is an annual taxpayer which incorporates the details of all inward and outward supply for goods during the relevant previous year. A regular taxpayer can file it.

GSTR 9 eliminates the following taxpayer:

- The taxpayer opted for a composition scheme.

- Casual taxpayer person.

- Input service distributors.

- Non-resident persons.

GSTR-9A

GSTR-9A

It is termed as an annual return payable by a regular taxpayer who opted for a “composition scheme in a financial year”. It is a consolidation of all quarterly returns that are filed during a financial year.

GSTR-9C

GSTR-9C

It includes those taxpayers who have a turnover of more than Rs 2 crore in a given financial year.

It is a reconciliation between the audited financial statement and the annual return. Hence, A taxpayer having a PAN can file GSTR 9C.

A regular taxpayer with having GSTIN number can file GSTR 9 and 9C.

GSTR-10

GSTR-10

From the date of cancellation of GSTR, a taxpayer is required to file GST return within 3 months of the cancellation period.

GSTR-11

GSTR-11

GSTR 11 grants a liability to refund GST only to those taxpayers who are either foreign diplomats or belong to embassies that have a UIN number. In this type of GST return a taxpayer needs to show inward supply received and refund claimed.

Late Filing of GST Return

Filing a return is mandatory to avoid both penalty or late fee whether if there is no transaction still a taxpayer needs to file a return.

- A regular taxpayer will not be able to file a new return until paying a previous monthly/quarter return.

- On the late filing of GSTR, there may be some cascading effects in terms of heavy fines or penalties.

Moreover, If you want any other guidance related to GST Registration or GST Return filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.