The UAE has boosted economic ties with India by launching Unified Payments Interface (UPI) for Indian residents and tourists. This service lets NRIs and Indian visitors make QR-based payments directly from their Indian bank accounts while in the UAE.

How does UPI work in the UAE?

In the UAE, UPI users may make purchases by scanning QR codes at participating retailers. This implies that Indians in the UAE are no longer required to exchange money or carry cash.

They may make purchases straight from their Indian bank accounts, making shopping and dining more convenient.

For Indian travelers, this eliminates the need for currency exchange and ensures a safe, cashless experience in popular destinations like Dubai and Abu Dhabi.

How businesses will benefit from QR Code UPI payments in UAE

Businesses in the UAE that accept UPI payments can expect various benefits. Businesses accepting UPI can benefit from the UAE’s popularity among Indian tourists and its large Indian community.

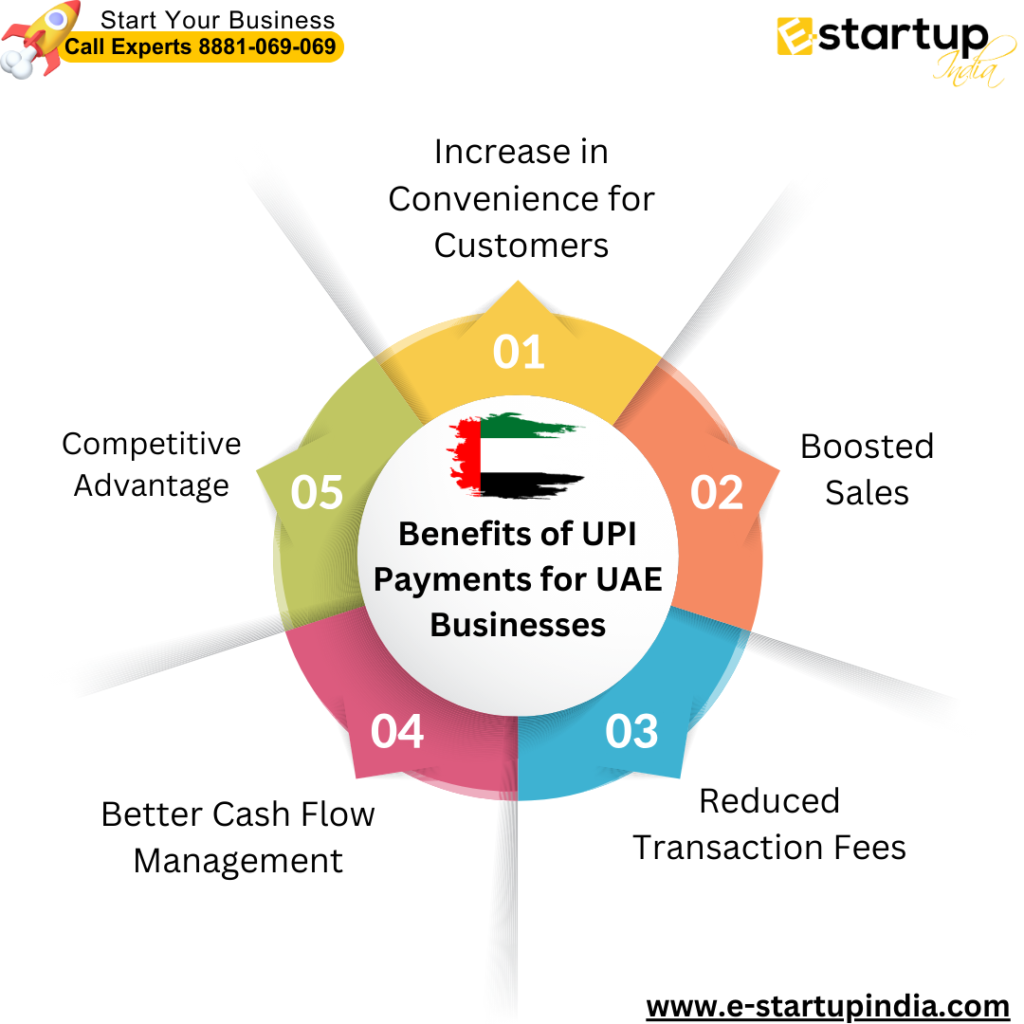

- Increase in Convenience for Customers: Accepting UPI payments benefits Indian customers by enhancing their purchasing experience and making payment easier.

- Boosted Sales: With a quick and easy payment option, clients may be more likely to spend, resulting in greater sales for businesses.

- Reduced Transaction Fees: UPI transactions often have cheaper fees than foreign credit card payments, saving firms money on operating expenses.

- Better Cash Flow Management: Businesses can better manage their cash flow and ensure timely access to funds by using real-time payment settlements.

- Competitive Advantage: By accepting UPI, companies get an advantage in acquiring Indian clients, distinguishing themselves from competitors who may not provide this payment method.

These benefits make UPI an appealing choice for retail stores, restaurants, and hospitality businesses in UAE hotspots like Dubai and Abu Dhabi.

UPI and Business Setup in the UAE

UPI integration also offers an advantage to NRIs looking to register a company in Dubai or complete UAE business registration. Since the Indian community in the UAE values convenient payments, UPI becomes a valuable asset for startups catering to Indian customers.

Accepting UPI payments helps businesses create a consumer-friendly atmosphere, leading to higher customer satisfaction and loyalty from the start. This is especially useful for businesses targeting Indian citizens and visitors in the UAE.

Read More: How to start business in dubai from India

Conclusion

To summarise, the use of UPI in the UAE helps both consumers and businesses. For Indian visitors and NRIs, it provides quick, simple, and safe payments without the need for currency exchange. For UAE firms, it provides an opportunity to attract and sustain a loyal Indian consumer base, hence increasing sales and customer satisfaction.

Moreover, If you want any other guidance relating to UAE Visa-on-Arrival Policy For Indians, business setup in Dubai, please feel free to talk to our business advisors at 8881-069-069 .

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.