Income tax returns (ITR) are only necessary for India if an individual’s taxable revenues exceed the Rs 2.5 Lakhs exemption threshold for the fiscal year. NIL tax returns are not required for individuals whose gross income falls below this threshold. However, it’s still a good idea to file a tax return even if your tax return is below the threshold. Certainly, there are benefits of Income Tax return filing on Time for everyone whether Income exceeds the threshold or not. In this article, you will know about the Benefits of Filing Income Tax Return on Time.

What is Income Tax Return Filing?

The term “income tax return” refers to a document or form used by individuals and businesses to report their taxable earnings, exemptions, and deductions for a specific fiscal year.

Taxpayers are required to submit an ITR for a variety of reasons, the most important of which is claiming tax deductions.

A total of seven different tax forms, namely ITRs 1, 2, 3, 4, 5, 6, and 7, are available.

Every taxpayer is required to submit their ITR by the due date. The application of ITR forms varies according to the sources of income of the taxpayer, the amount of money earned and the category of the taxpayer, such as individuals, HUF, companies, etc.

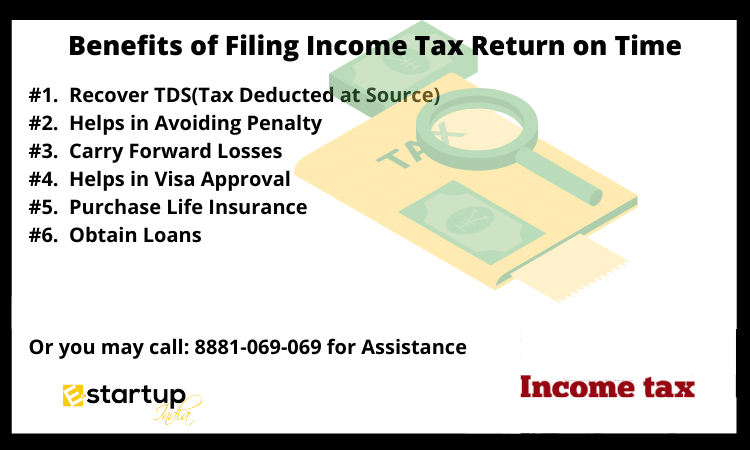

What are the benefits of filing Income Tax Return on Time?

- Recover TDS(Tax Deducted at Source)

Taxes can be withdrawn from your paycheck, Fixed Deposit, or any other income stream, even if you don’t have taxable income. Banks are required to withhold 10% of your interest income out of a Fixed Deposit(FD) if your income is less than Rs. 2.5 lakhs. An individual must do ITR Filing in order to recover any TDS deducted.

- Avoid Penalty and Notices from Income Tax Department

Notices from the Income Tax Department may be sent to those who fail to file their Income tax department on time. This can cause you a lot of unnecessary stress. As a result, it’s important that you submit your ITR on time. Delayed ITR filing has a penalty too. According to ITR Rules and Regulations, the penalties can be imposed for failing to file an ITR on time. The penalty can go up to Rs. 10,000.

- Carry Forward Losses

It’s possible for any corporation to go into the red at some point throughout a financial year. In the next year, the tax losses can be carried forward using ITR Filing.

- Get Visa Approval

Visa applications cannot be processed without an ITR filing. The ITR receipt is requested by the international embassies. The applicant’s tax return serves as income proof, and the embassy will verify the information to make sure the applicant can afford to travel. Individuals who are salaried or self-employed can take advantage of this by filing their ITR on time.

- Purchase Life Insurance

Life insurance policies for more than Rs. 50 lakh are becoming more popular these days. As a result, insurance companies only permit this if you provide your Income Tax Return Filing records to show your annual income. Your working income determines how much healthcare insurance you get, and your ITR shows the insurance company that you have a lot of revenue.

- Obtain Loans

Banks and other financial institutions are more willing to approve loans to ITR filing customers. When you apply for a loan, the banks will demand a copy of your ITR statement as evidence of income. Thus, Those who do not submit an ITR on time may have a tough time getting a loan accepted by a legitimate lender.

Moreover, If you want any other guidance relating to ITR Filling, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.