It’s common for businesses to raise money through stock or equity offerings, such as for expansion and debt repayment. However, the two terms such as authorized share capital and paid-up. We’ll go through some of the terminologies such as authorized capital and paid-up capital that comes up when a company issues shares in order to generate money in this article.

What is an Authorized Share Capital?

- The maximum amount of capital a corporation can legally raise from its shareholders via the issuance of shares is known as authorized share capital.

- It is not necessary for a corporation to issue all of its authorized share capital through a public offering. Depending on the company’s needs, it may opt to issue capital at various points throughout the process.

- The authorized capital of a corporation must be stated in the Memorandum of Association (MOA).

- The authorized capital is listed in the Company’s Memorandum of Association under the heading “Capital Clause.”

- Authorized Share capital is decided prior to the Company Formation.

- It is possible to expand the authorized capital at any moment after fulfilling the relevant legal requirements.

What is Paid-up Capital?

- A company’s paid-up capital is the amount of money that shareholders have invested in the business in exchange for the shares they own.

- It is the actual and first capital raised by the corporation via the issuance of shares.

- Typically, a corporation raises money by issuing new shares of stock, which are then included in the firm’s paid-up capital.

- A company’s paid-up capital is always less than its authorized share capital since it cannot issue shares beyond the limit of its authorized share capital.

- Prior to the Companies Act, 2013, private limited companies were required to have a minimum paid-up capital of Rs. One lakh under the Companies Act 2013. Thus, stockholders had to invest Rs. One lakh in the firm by purchasing shares.

- However, There is now relief for small businesses under the Companies Amendment Act, 2015. As a result, no minimum initial investment is required to establish a private limited company.

- Thus, You can have Online Private Limited Company Registration with even zero paid-up capital.

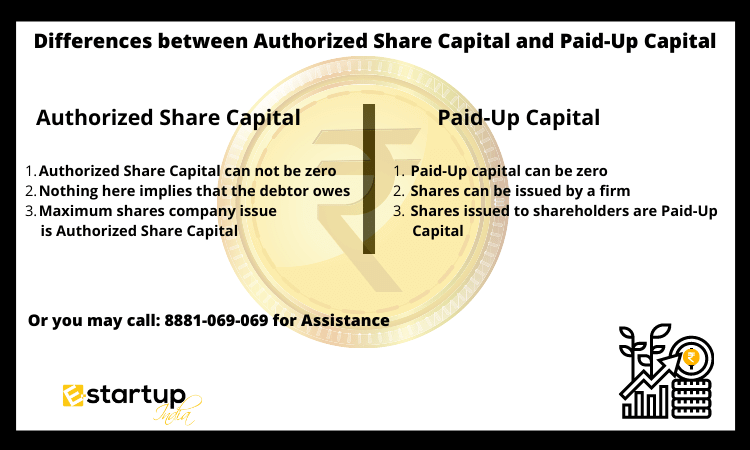

Know about the differences between Authorized Share Capital and Paid-Up Capital

| Authorized Share Capital | Paid-Up Capital |

|---|---|

| The Maximum Amount of shares the company can issue is known as Authorized Share Capital. |

The Amount of Shares the company issues to the shareholders is known as Paid-Up Capital. |

| To increase the Authorized Share Capital, you need to comply with all the legal requirements first. | You can easily increase the paid-up capital up to the amount of Authorized Share Capital. |

| Authorized Share Capital can not be zero. | Paid-Up capital can be zero. |

| Nothing here implies that the debtor owes anyone anything. | Shares can be issued and repurchased by a firm, but only if certain requirements are met. |

What are the benefits of Increasing Authorized Share Capital?

- The firm will be able to focus on its business expansion without borrowing money or receiving funding from traditional sources thanks to the additional revenue gained from stock sales.

- The company’s total value rises as a result of increased share capital. To put it another way, this boosts the company’s borrowing power.

Moreover, If you want any other guidance relating to Company Registration. Please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.