GST is an indirect tax imposed on the supply of goods and services in India. The GST has lowered the burden of many taxes and placed them under one roof, benefiting Indian consumers and companies. Hence, there are several benefits of GST on Business and Consumers. In this article, you will understand GST Registration and the Benefits of GST on business and consumers.

What is GST Registration?

People who want to be registered or have to be registered for the Goods and Service Tax (GST) have to do GST registration.

The Goods and Service Tax Identification Number (GSTIN) is supplied upon the completion of the registration procedure.

The 15-digit GSTIN is issued by the Central Government and is used to establish if a firm is required to pay the GST tax.

Document Requirement for GST Registration in India

- PAN Registration

- Address Proof and Identity Proof of Promoters

- Address Proof of Business Premises

- Bank Account Proof

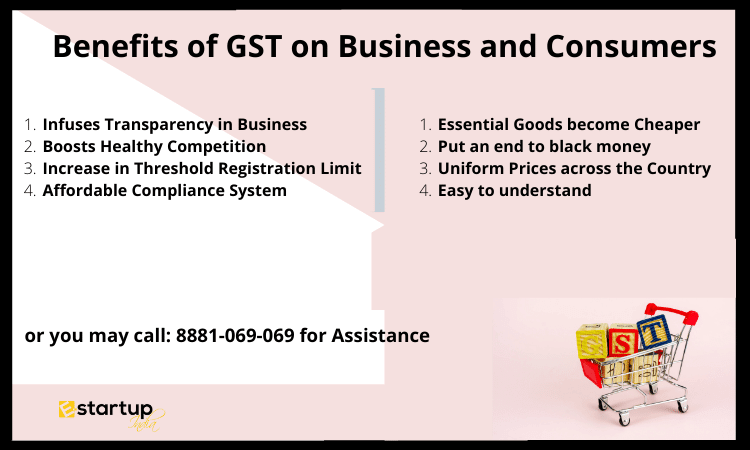

Benefits of GST on Business and Consumers

The several benefits of GST on Business and Consumers are highlighted below:

Benefits of GST on Business

-

Infuses Transparency in Business

One of the main benefits of GST is its transparency. It simplifies the business process for merchants because they are required to pay GST on all purchases made along the supply chain.

-

Helps Small Businesses

Smaller towns in India would benefit greatly from the implementation of the Goods and Services Tax (GST). Because GST has replaced different indirect taxes on products and services, it would not only make conducting business easier, but it will also assure improved tax compliance among firms.

-

The procedure is Online and Automated

Various operations, such as registration, returns, refunds, tax payments, etc., are streamlined and automated. When it comes to dealing with taxes, there is little public engagement between taxpayers and tax authorities.

-

Boosts Healthy Competition

GST abolished the old system of several indirect taxes by combining them into a single tax. It boosts competitiveness and boosts the cash flow.

-

Increase in Threshold Registration Limit

There has been a significant rise in the turnover cap under the GST system to Rs 20 and 40 lakhs, which frees many small businesses.

-

Affordable Compliance System

It is less expensive to comply with GST since there is no need to keep separate records for various taxes. As a result, record-keeping requires less investment in terms of money and labour. Thus, the GST Laws, processes, and tax rates that apply uniformly across the country help to keep compliance costs down.

Benefits of GST on Consumers

- Essential Goods become Cheaper

Since the GST rate for basic food grains and spices is 0-5 per cent, buyers may save significantly on their purchases. Products such as shampoos, tissues and toothpaste have also gotten more affordable.

-

Put an end to black money

An increase in output will eventually lead to an increase in job possibilities. Furthermore, GST stops the flow of illegal money.

-

Uniform Prices across the Country

With GST, consumers may get their goods at the same price regardless of where they live. This is a big benefit for consumers.

-

Easy to understand & Boosts trustworthiness

The former indirect tax structure was quite difficult for the average person to comprehend. Due to the computerization of the GST, consumers and businesses alike will have more confidence in tax administrators and businesses as a result of the increased mutual trust. Consumers will have more faith in a streamlined tax system as a result of this.

-

Boosts Import and Export Industry

It will also help the Import and Export industry when foreign investors come to the country because of GST. The greater the volume of commerce, the greater the number of job chances. There will be more employment for the jobless and more enterprises will enter the market. The country’s general economic status improves.

Conclusion

GST has several benefits. Some of the most important benefits that you must know as a common man or a business are highlighted above. If you need more guidance related to GST Registration or GST Return Filing, you can consult our team of professionals having business advisors, company secretaries, chartered accountants etc.

Moreover, If you want any other guidance relating to GST Return Filing or GST Registration in India, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.