In India, most purchases, including automobiles or cars, are subject to the Goods and Services Tax (GST). India’s Goods and Services Tax (GST) on automobiles is charged at a variety of different rates, including 5%, 12%, 18%, and 28%. Vehicle sales are subject to both GST and another tax, a compensation cess of up to 22%, depending on the state. So, with the implementation of GST, the maximum tax rate for automobiles or cars might reach 50%. In this article, you will understand the GST and Cess on cars in India.

What is Compensation Cess in GST Act?

Compensation Cess is a type of tax that is applied in addition to the GST. It is generally applied to luxury and sin goods. In India, the Compensation Cess is applied to the following:

- Motor vehicles

- Aerated water

- Various types of solid fuel such as coal, briquettes, ovoids and other coal derivatives

- Tobacco and tobacco products including cigarettes

Is GST applicable on Cars for personal use?

The Goods and Services Tax (GST) ranges from 5% to 12% on several types of personal transportation vehicles including cars. Accessories and replacement components for privately owned automobiles are likewise subject to the Goods and Services Tax (GST). Carriages used by the disabled, whether motorized or not, are subject to GST at the lowest rate of 5%. Accessible carriage components and accessories are also subject to the same 5% GST rate. This new, lower rate was approved during the 31st meeting of the GST Council in December of 2018. The 12% GST Rates is applicable on following cars and vehicles:

- Electric Cars (all sizes including 2 and 3 wheelers)

- Fuel Cell Vehicles including hydrogen fuel cell vehicles

- Bicycles and other non-motorized cycles

- Hand propelled vehicles such as rickshaws, hand carts, etc. as well as animal drawn vehicles

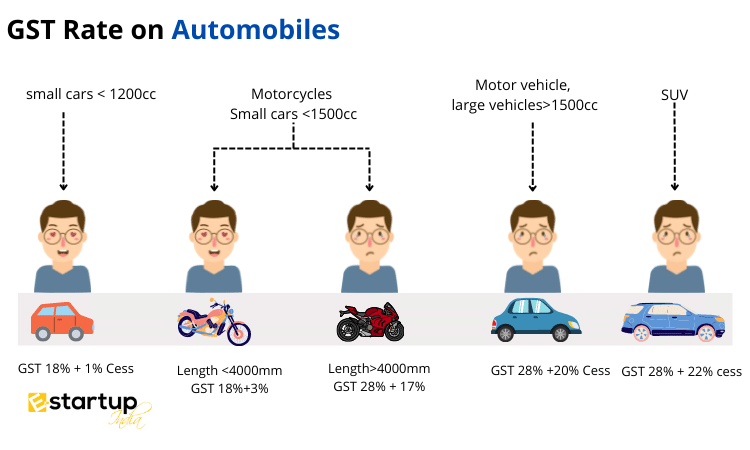

Cars for physically handicapped people and Baby carriages and its replacement parts attract 18% GST Rate. Cars purchased for personal use are subject to a 28% GST rate, with the compensating cess potentially varying depending on criteria such the vehicle’s engine size and overall length. Such details are in accordance with the Motor Vehicle Act of 1988.

Are Commercial Vehicles Subject to GST?

GST rates normally range from 12% to 28% for commercial vehicles, including those used for transporting passengers, products, or agricultural equipment.

GST Rate 12% Applicable on Commercial Vehicles

- Tractors except road tractors for semi-trailers having 1800cc Engine

- Self-loading or unloading trailers for agriculture

GST Rate 18% Applicable on Commercial Vehicles

- Buses

- Refrigerated Motor Vehicles

- crane lorries, breakdown lorries, concrete-mixer lorries, etc.

- Self-propelled work trucks

- Various tractors parts

28% rate of GST on cars and other vehicles for commercial use

- Automobiles for transport of 10 people or more

- Cars or Automobiles for transport of goods

- Various kinds of automobile parts

Know more about GST on Automobiles at: 7 Things to Know about GST on Automobile Industry

Is GST applicable on sale of cars by company after being used for commercial purposes?

Yes, the GST is applicable on sale of cars by company after being used for commercial purposes. The GST Rate applicable is 18% where 9% is SGST and 9% CGST.

What is the GST Rate for used cars in India?

Historically, the GST and compensating cess on used automobiles were the same as those on new ones. However, rates were lowered to stimulate demand for pre-owned vehicles. Smaller pre-owned automobiles, defined as petrol engines with an engine size of up to 1200cc and diesel cars with an engine capacity of up to 1500cc, are subject to a 12% rate under the present regime. Used vehicles with engines larger than 1200cc for petrol and 1500cc for diesel are now subject to an 18% GST.

Is GST Applicable on Electric Cars and Vehicles?

Initially, the GST rate on EVs and their essential accessories like EV chargers and EV charging stations was 18%. However, the GST rate on EVs was decreased to 5% in the 36th GST Council meeting held on July 27, 2019. Also announced at this meeting was a 5% GST rate that would apply to electric vehicle chargers and charging stations. The new, lower rate came into effect on August 1, 2019. It’s worth noting that the 5% GST rate will be applied to all EVs, whether they’re used for personal or business purposes. Read GST on Electric Vehicles to understand in detail or call our experts at: 8881-069-069.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.