The government of India implemented the indirect tax system known as GST (Goods and Service Tax) in 2017. Because of the difficulties that taxpayers encountered, a unified system of taxes was developed. Since 2017, all businesses in India have been required to collect GST from their customers. Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST) are added together to form the GST tax. There is no GST on many goods and services, and the highest GST rate under the current system is 28%. Know all about GST on public transport services through this article.

GST Taxation on Transportation Sector

GST levied on the transport industry relates to all forms of transportation i.e. by road, rail, airways and waterways. Taxes such as Value-Added Tax, Service Tax, Central Excise Duty, Sales Tax, Purchase Tax, Entry Tax, Customs Duty, and so on have been replaced by the more uniform Goods and Services Tax (GST). The objective of implementing this taxation was to reduce the many taxes charged that differed state-wise and the burdensome compliance that had to be adhered to under each relevant tax legislation. The information of the GST levied on the Transport industry is listed below.

GST on Air Transport

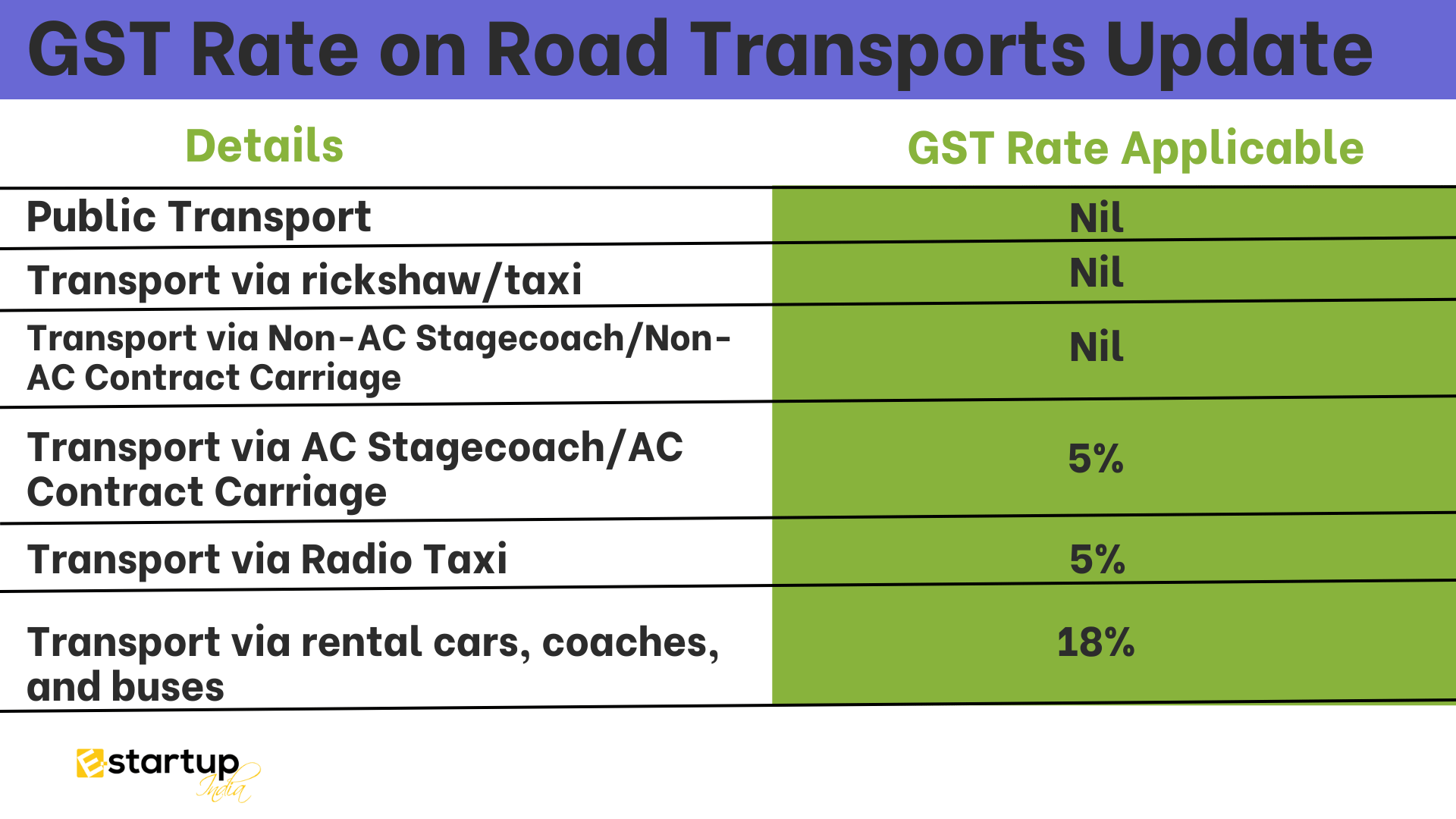

GST Rate on Road Transport

| Details | GST Rate Applicable |

| Public Transport | Nil |

| Transport via rickshaw/taxi | Nil |

| Transport via Non-AC Stagecoach/Non-AC Contract Carriage | Nil |

| Transport via AC Stagecoach/AC Contract Carriage | 5% |

| Transport via Radio Taxi | 5% |

| Transport via rental cars, coaches, and buses | 18% |

GST Rate on Rail

| Details | GST Rate Applicable |

| First Class/AC Tickets | 5% |

| General/Sleeper Class Tickets | 5% |

| Metro Tickets | 12% |

Other importance of GST on Transport Sector

Standard shipping procedures allow for the use of any of the two transit options. A GTA (goods transport agency) or carrier is one of these options.

GTA is the form of transport where the GTA is a service provider providing the service of transportation of products through a fleet of rented cars. Contrarily, those who possess modes of transportation are the ones who drive them.

GTAs provide services including loading and unloading cargo, packing and unpacking cargo, transshipment, and short-term storage.

It’s crucial to remember that the road carrier must provide the consignment note to fall under the scope of GTA. In the absence of such a consignment note, the service provider will be excluded from GTA’s purview.

The lien of goods has been transferred to the carrier with the issuance of a consignment note. This means that the carrier is accountable for the items till the moment they are officially delivered to the consignee.

Input tax credit utilization determines the GST rate applied in the GTA. Information on this is tabulated below.

| Input Tax Credit | Rate of GST |

| Availed | 12% |

| Not availed | 5% |

| Rental Services | Rate of GST |

| Road Vehicles including trucks (with or without operator) | 18% |

| Freight Aircraft (with/without operator) | 18% |

| Water Vessels including Freight Vessels (with/without operator) | 18% |

For more detailed info, you can visit: Specifically exempt Good Transport Agency services under GST.

Conclusion

In conclusion, Rapid industrialization and economic expansion are both aided by reliable and timely freight transit. Although the government’s GST on transportation costs has a little impact on pricing, it has helped the government bring in some much-needed cash.

Moreover, If you want any other guidance relating to GST Return Filing or GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.