Do you wish to expand your business? Converting your business from sole proprietor to LLP in India will help.

Learn the process to convert Sole proprietor to LLP along with benefits in this article.

Is it possible to convert Sole Proprietor Business to LLP Firm in India?

You can not convert Sole Proprietor Business to LLP Firm directly as there is a single business owner in Sole Proprietor business.

LLP needs at least two business owners.

However, you can easily close your sole proprietor registration.

And then begin with a new LLP Registration by adding one more business partner.

Stepwise Process to convert Sole Proprietor business to LLP Firm

Step 1. Find a new business partner & Apply for Designated Partner Identification Number (DPIN):

LLP Registration requires at least two partners and there is no upper limit on the maximum number of business partners that a LLP can have.

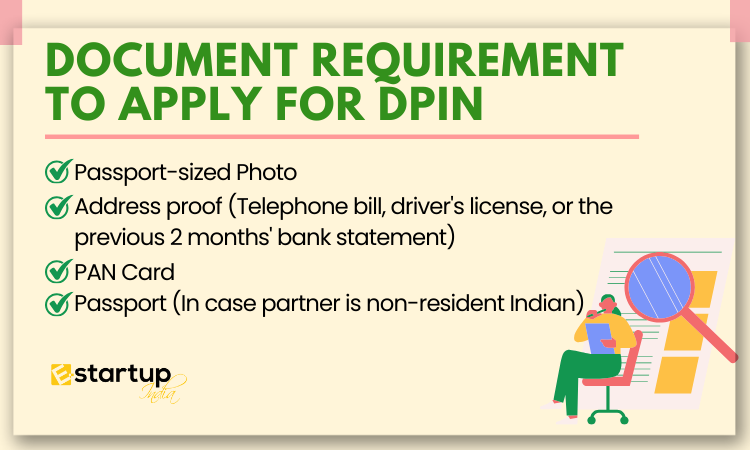

So, once your business partner is ready, you have to apply for DPIN(Designated Partner Identification Number).

What is DPIN?

A Designated Partner Identification Number (DPIN) is an exclusive identifier issued to individuals serving as designated partners in a limited liability partnership (LLP).

To acquire a DPIN, designated partners are required to complete an online application via the Ministry of Corporate Affairs’ official website.

Step 2. Acquire or Register Digital Signature Certificate (DSC):

Using the DPIN, you can apply for a DSC for the two designated partners.

Submit the same documents as required for DIN 1, along with the e-form.

To get LLP Registration, it is necessary to possess a Digital Signature (DSC) because all the documents must be digitally signed prior to their online submission on the MCA portal.

Step 3. Incorporate the LLP (Limited Liability Partnership):

- Fill out Form 1 for name confirmation.

- Once the name is confirmed, fill out Form 2 to complete the LLP incorporation process.

- File the LLP Agreement

- After successfully incorporating the LLP, file the initial LLP agreement within 30 days of the LLP’s incorporation.

- Seamless Asset Transfer: Upon conversion, all the firm’s assets and liabilities seamlessly transition to the LLP.

- No Stamp Duty Required: The transfer of movable and immovable properties to the LLP doesn’t necessitate any instrument of transfer or stamp duty payment.

- Tax Savings: There’s no capital gains tax imposed when transferring property from the firm to the LLP.

- Enhanced Financial Flexibility: The firm’s accumulated losses and unabsorbed depreciation are considered as losses/depreciation of the successor LLP for the conversion year, allowing for an extended carryforward period of eight years.

What is the minimum capital requirement for LLP Registration?

In an LLP, there is no obligatory minimum capital requirement, allowing the formation of an LLP with the smallest amount of capital. Additionally, partners can contribute tangible, movable, immovable, intangible assets, or other valuable benefits to the LLP.

Moreover, If you want any other guidance relating to LLP Registration. please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.