GSTR-2A, is an automatically generated tax return for purchases, created by the GST site upon a vendor’s GSTR-1 submission. It is important for businesses to use GSTR-2A to claim input tax credit in GSTR-3B and GSTR-9 filings. So, learning about the process to view GSTR 2A on the GST Portal is crucial and we will discuss it in this article.

Stepwise Process to view GSTR 2A on GST Portal

Step 1 – Firstly, Log in to the GST Portal.

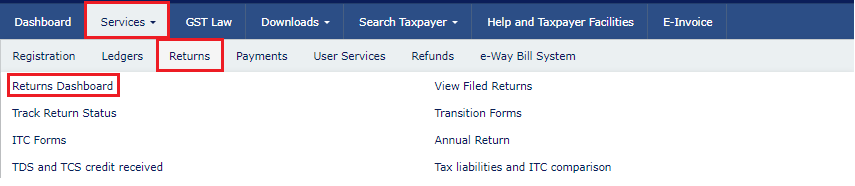

Step 2 – Navigate to Services, and from the drop-down menu, select Returns > Returns Dashboard.

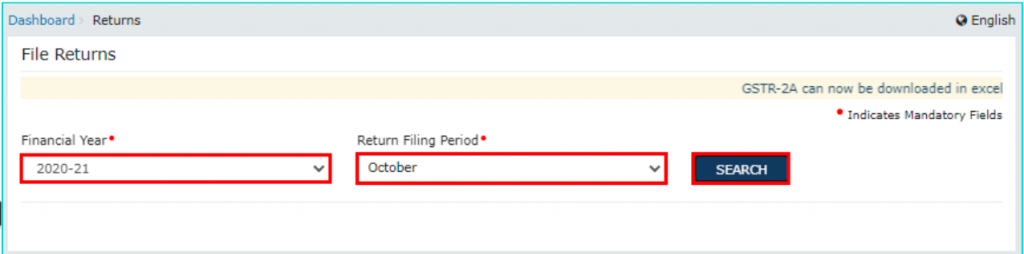

Step 3 – Choose the Financial Year plus Return Filing Period from the drop-down options, then click the ‘Search’ button.

Step 4 – Select the ‘View’ button within the tile.

Step 5 – You will be able to see the auto-generated details now.

Understand the Various components of GSTR 2A on GST Portal

- You can access B2B Invoices in Part A by clicking on GSTIN to review supplier-uploaded invoices, automatically filled based on your filed returns. In addition, in Part A, you can also view Amendments to B2B Invoices, seeing modifications made by suppliers in their GSTR 1 or GSTR 5. Furthermore, you can proceed to Credit/Debit Notes in Part A, exploring added credit/debit notes by suppliers. Click on the tile for GSTIN-specific details.

- Check Amendments to Credit/Debit Notes in Part A for details on changes made by suppliers to credit/debit notes. Click on the tile for supplier-wise details.

- In Part B, you can further explore ISD Credits where details are automatically populated from GSTR 6 filed by an Input Service Distributor. Use the amendment option if necessary.

- In Part C, you can find TDS Credits auto-populated from GSTR 7 filed by dealers deducting TDS.

- You can see the TCS Credits in Part C for details on TCS collected by dealers, automatically filled based on GSTR 8 filed by the TCS collector. Hence, In Part D, you can get details of imported goods from overseas based on the bill of entry.

Also Read:

Moreover, If you want any other guidance relating to GST Return Filing online, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.