In order with the announcement by the Government, while presenting the Union Budget 2020, to reduce tax disputes the Direct Tax Vivad Se Vishwas Act, 2020. In this article, we will discuss the Income Tax Dispute Settlement Scheme 2020.

About Vivad se Vishwas Act, 2020

Vivad se Vishwas Act has been passed on 17 March 2020. The Scheme proffers a short window for taxpayers to settle their tax disputes by partly paying their tax arrears. To address the doubts of stakeholders and provide guidance about the law, the Central Board of Direct Taxes (CBDT).

Income Tax Dispute Settlement Scheme 2020

The Scheme renders an option for the taxpayers to resolve their tax disputes under the Indian Income Tax Act, 1961 (IT Act) by paying a portion of tax arrears.

- “The finance ministry has extended the deadline for getting amounts following the ‘Vivad se Vishwas Scheme’ (tax dispute settlement scheme), from 31st December to 31st March 2021, on the provision that a person needs to appeal for it on or before 31st December 2020”.

- As per the newest resources and government authorities, the tax department has been able to determine almost 35,000 cases of direct taxes within the ambit of vivad se Vishwas scheme aimed to resolve the tax disputes among multiple parties across the country

- OurHonorable Prime Minister Narendra Modi stated that the newly introduced and updated laws reduced the legal burden from the tax system. One such improvement is that now only cases concerning up to 1 crore rupees can be listed in the High Court and it has been fixed, whereas cases up to 2 crores will be listed in the Supreme Court.

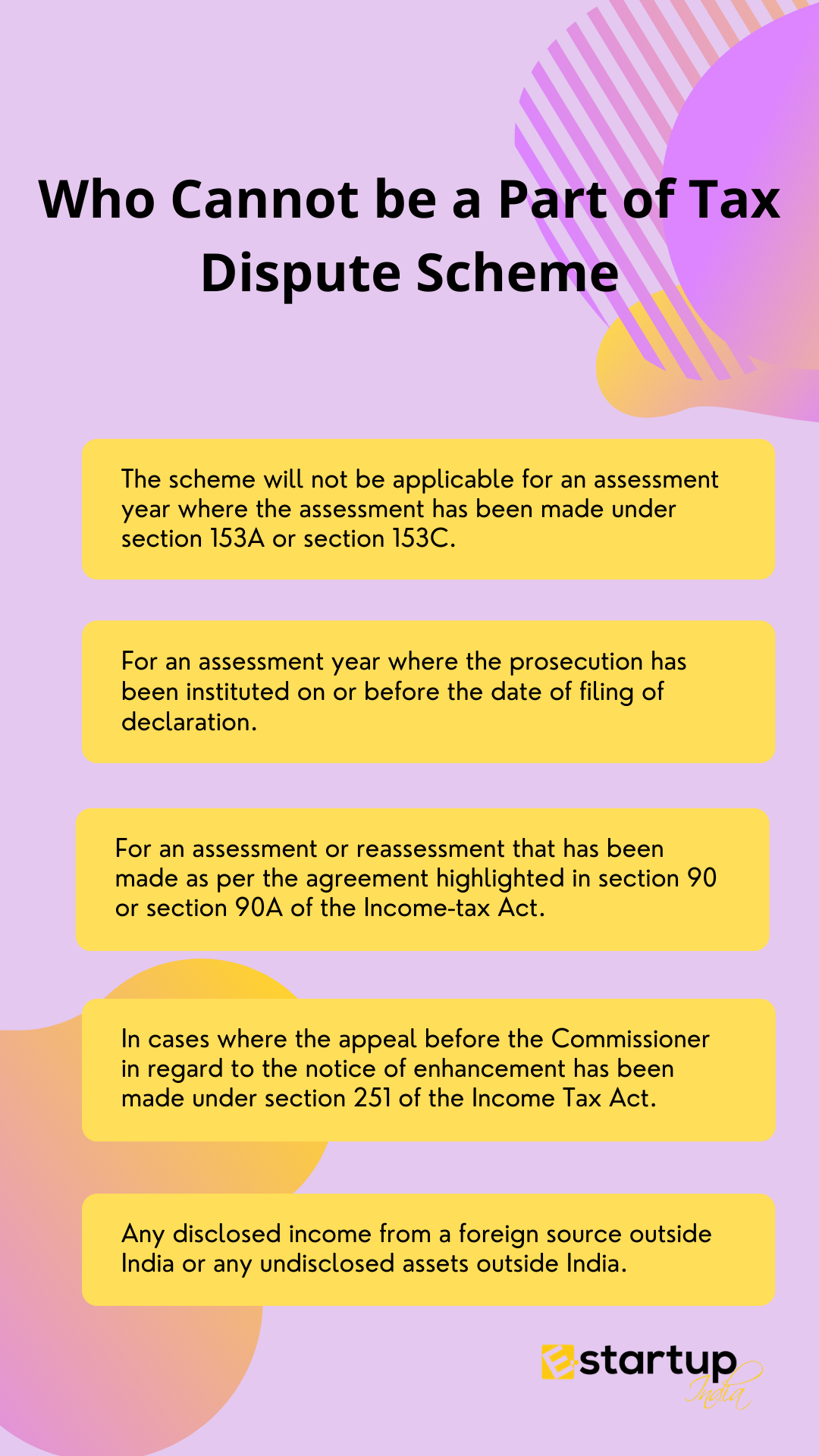

Which tax disputes are excluded from the Scheme?

- Search cases where disputed tax amount passes INR 5 crore;

- Cases where the prosecution has been inducted;

- Cases including undisclosed income from a source outside India or an undisclosed asset located outside India;

- Cases of tax disputes following assessment or reassessment made on the basis of information obtained under tax treaties or information exchange agreements.

Income tax return filing deadline for FY2019-20 extended till Dec 31

Who cannot get benefits under the Scheme?

- Persons opposite whom an order of detention has been made under the provisions of the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974.

- Persons indicted or convicted for any offense punishable under the provisions of the Unlawful Activities (Prevention) Act, 1967, the Narcotic Drugs and Psychotropic Substances Act, 1985.

- Persons against whom prosecution has been begun by revenue authorities for any offense punishable under the provisions of the Indian Penal Code, or for the determination of enforcement of any civil liability under any law.

If you want any other guidance concerning ITR Filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.