Taking a major step to boost exports, CBIC issued the notification to extend the benefit of the scheme for Remission of Duties and Taxes on Exported Products. In this article, we will discuss on RoDTEP Scheme gets implemented from Jan 1.

RoDTEP Scheme gets implemented from Jan 1

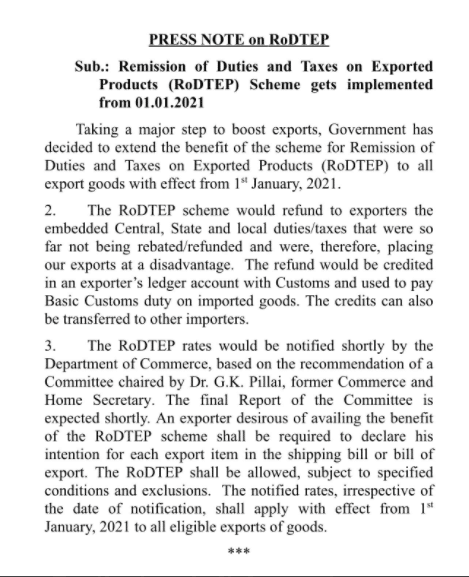

CBIC has announced the new scheme i.e Remission of Duties and Taxes on Exported Products. As per the press release, effective 1 January 2021, the advantage under RoDTEP scheme shall be permitted on all export goods. The scheme will refund to the central, state and local duties/ taxes that were so far not being rebated/ refunded. The rates in this regard will be notified soon.

Under the scheme, the embedded central, state and local duties or taxes will receive refunded and credited in an exporter’s ledger account with customs. This can be practised to pay basic customs duty on imported goods. The credits can also be carried to other importers. The major reason for implementing the scheme that refunds were not taking place and adversely impacting exports. India’s exports fell 8.74% in November, steeper than 5.12% dip in October at $23.52 billion.

NOTE- Earlier, the Government had approved the RoDTEP scheme in March 2020.

Further Notification by CBIC

The claim value will be available to the exporter as credits on ICEGATE portal. The exporter will be capable to club the credits allowed for any number of shipping bills at a port and generate credit scrip for the same. Such scrip can be either applied to pay a basic customs duty or transferred to other importers.

Further, significant changes have been made in the Customs Automated System to accept and process the claims. The exporter will be obligated to indicate in the shipping bill his intent to claim the benefit of RoDTEP in respect of each export item. RoDTEP shall be provided subject to fulfilment of certain conditions and exclusions as may be notified.

According to the CBIC, the declaration is specifically made in the shipping bill, no benefit will extend to the exporter. Once the rates are notified, the system would automatically determine the claim amount for all the details where the declaration is made. No changes in the claim will be allowed after filing of the export general manifest.

If you want any other guidance concerning IEC Code online, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.