Choosing the correct business structure is essential to your company’s success. The most common business structures for Company Registration in the USA are LLC or S-corp. The difference between an LLC and an S-corp can be complex. Hence, clearly understanding the difference between business entities while having company registration in the USA from India is essential for you to save time, energy, and money. In this article, you will understand the difference between LLC and S-Corp.

What is LLC?

A limited liability corporation (LLC) is a corporate structure that shields its owners from personal accountability for the debts and liabilities that their firm may incur. Thus, the owner’s own financial resources cannot be utilized to pursue legal action against the company.

In an LLC, the owners are known as “members,” and the company might be owned by a single person or a group of members. In other words, An LLC is a combination of a partnership and a corporation. For small and medium-sized firms and entrepreneurs, LLCs are a popular corporate form because of their ease of implementation.

Moreover, LLC Company Registration in the USA from India offers legal immunity that sole proprietorships and partnership firms do not.

What is S-Corp?

In the United States, an S corporation usually referred to as an S subchapter, is a legal corporate organization. Eligible companies having less than 100 shareholders get taxation benefits when they have company registration in the USA as an S-Corp. On their tax returns, stockholders record income and losses and pay standard tax rates. Individuals, particular trusts and estates, or certain tax-exempt organizations can be stockholders in an S-Corp.

What is the difference between LLC and S-Corp?

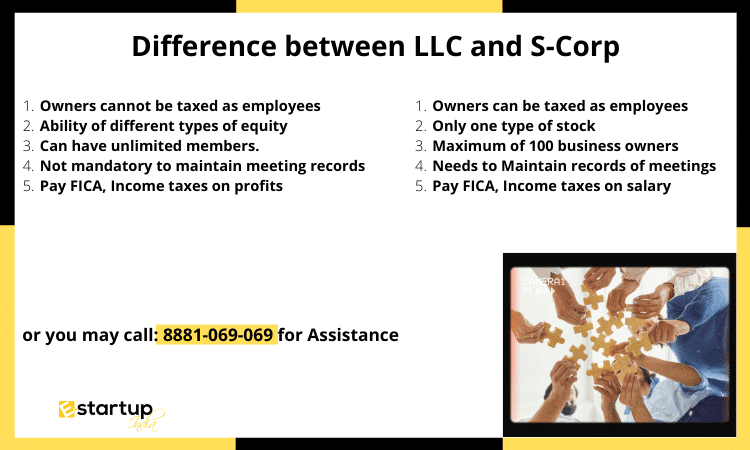

| LLC Company Registration in USA | S-Corp Company Registration in USA |

| In an LLC Company, Business owners cannot be taxed as employees of the company. | An S-Corp, Business Owners can be taxed as employees of the company. |

| You can have different types of equity. | Here, you can have only one type of stock. |

| LLC can have unlimited members. | S-Corp can only have a maximum of 100 business owners. |

| LLCs don’t need to maintain records of meetings and decisions. | S-Corp must maintain records of meetings and decisions. |

| Business owners pay FICA, Income taxes on profits. | Business owners pay FICA and income taxes on salary. |

Advantages of S-Corp Company Registration in the USA from India

- S corporations are exempt from paying corporate income taxes in the United States. As a result, the owner of an S company may be able to save on business taxes.

- An S corporation that has been in existence for a long period of time is seen as more trustworthy by suppliers, investors, and consumers.

- Personal assets of an S corporation’s owner are shielded from creditors in order to pay off the company’s debts, making them less vulnerable to individual accountability.

- Employees of S corporations are also members, making them eligible for dividend payments from the company’s earnings

- Earning a portion of a company’s profits in the form of a dividend may be a wonderful way for the owner to recruit and retain top-notch staff.

Advantages of LLC Company Registration in USA from India

- A limited liability corporation (LLC) protects its owners by limiting their liability for the firm’s debts and litigation.

- Creditors cannot seize your individual capital or assets to cover the business’s obligations. Creditors can only seize the company’s assets.

- LLCs are easier to set up and run than corporations. Usually, companies must have a board of directors, officials, and regular meetings of the board of directors which is not mandatory for LLC Companies.

- Additionally, LLCs have a wide range of options when it comes to their organizational structure. Unlike sole proprietorships, LLCs have no restriction on the number of owners or members, they can have.

- An LLC owner can choose a manager to administer the firm, which might be one of the chosen members, a non-member, or a combination of both.

Moreover, you require any kind of guidance related to company registration in USA. Please feel free to contact us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.