GST Return Filing is the online procedure through which tax payers declare their taxable turnover, determine and pay net tax liability. It is mandatory for every business having GST registration to file their GST returns as per the nature of business. There are 13 main GST returns. The GST-3B Return is among the most important returns. This article is the complete guide to GST-3B Return Filing.

What is GST-3B Return Filing?

GST-3B Return is a consolidated summary return of declaring sales and purchases made during the month. It is a self-declaration summary of sales, ITC claimed, and net tax payable.

The sole purpose of Form GSTR-3B is for the taxpayer to disclose and pay GST tax liability for the applicable tax period.

A normal taxpayer must submit Form GSTR-3B returns every month. The taxpayers registered under the QRMP Scheme have to file GSTR-3B every quarter.

Important: While reporting GSTR-3B filings, taxpayers are not required to provide any invoice data, unlike other GST forms.

When do I file GSTR-3B?

When do I file GSTR-3B?

Small taxpayers are allowed to choose the Quarterly Return Monthly Payment (QRMP) plan and submit Form GSTR 3B on a quarterly basis if their combined annual turnover is less than Rs. 5 crores. But normal taxpayers who have not opted for the QRMP Scheme must submit their returns on a monthly basis.

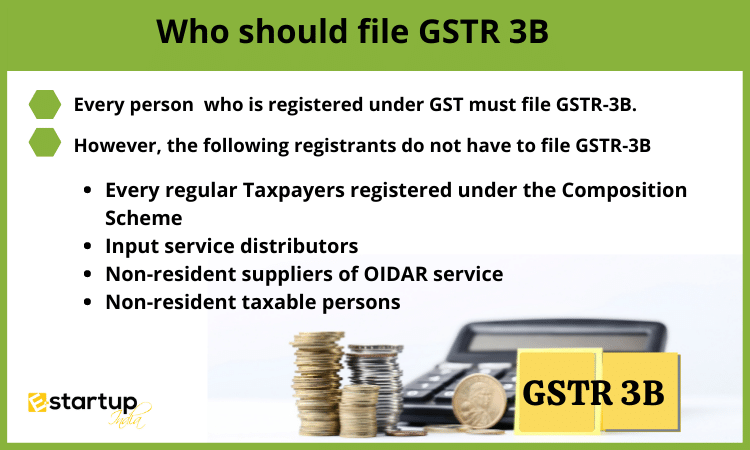

Who needs to do GST-3B Return Filing?

Every individual or business entity having GST Registration needs to do GST-3B Return Filing. The only exemption is available for the following people:

- Businesses having GST Registration under the Composition Scheme

- Input Service Distributors

- Suppliers of Online Information Database Access and Retrieval services

- Non-resident taxable people

Essentials for GSTR-3B Return Filing

- Already done GST Return Filing of GSTR-1, GSTR-2, and GSTR-3 monthly returns.

- Registered mobile number and Registered Account on GSTN Portal.

- Digital Signature Certificate (Class 2 or higher) or EVC.

How do I file GSTR-3B?

The registered individual has to visit the GST Common Portal and then complete the following procedures in order to file Form GSTR 3B:

- Visit the GST Common Portal and login using your credentials.

- In services, select the Returns option and go to the Returns Dashboard.

- Choose the GSTR-3B and time period for which the return has to be filed under “Returns Dashboard.”

- Complete the essential fields on Form GSTR-3B.

- Debit the amount to release the obligation to pay any due taxes, interest, penalties, fees, or other amounts.

- Use an EVC (electronic verification code) or a Digital Signature Certificate to verify the return.

- Your return will be filed following validation, a success message, and an acknowledgment reference number. You can also download the filled GST Return.

There are several QRMP Scheme Changes implemented on GST Portal for the taxpayers that facilitate the GSTR-3B Return Filing, You can also contact our GST Return Filing Experts at 8881-069-069 or info@e-startupindia.com and get your queries resolved for free.

Our guide to the Online Process of Filing NIL GST Return in India might also be helpful for you to understand the procedure of GST Return Filing.

Details necessary to furnish GSTR 3B

- Reverse charge and tax liability summary information for outbound and inbound supplies.

- information about interstate deliveries made to unregistered individuals, composition taxable individuals, and UIN holders.

- Accessible ITC, reversed ITC, available net ITC, unavailable ineligible ITC, etc.

- Brief descriptions of exempt, zero, and non-GST inbound supplies

- Information about interest and late fees

- Information about tax, interest, and late payments (if any)

- TDS/TCS credit information

What are the late fees or penalties for not filing GSTR-3B?

If you submit GSTR-3B for a tax period after the deadline, you will be penalized with a late fee. It is levied as per the following:

- Rs. 50 for each additional day of delay.

- For taxpayers who have no tax due for the month, the penalty is Rs. 20 per day of delay.

- In the event that the GST obligations are not settled by the deadline, interest at the rate of 18% annually is imposed on the balance of unpaid tax.

Moreover, If you want any other guidance relating to GST Return Filing or GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.