![instabill]() Instabill

Instabill

|

| Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

- Offers

|

| - Learning Resources |

- LOGIN/SIGN UP |

- 8881069069

|

| Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

|

| Secure Public limited company Registration in India with E-Startup India Experts Assistance. Public limited company registration helps in infuse more capital, few risks & better opportunities to grow and expand your business. Contact us now.

Neo Bank provides global bank accounts and cross-border remittance solutions, ensuring seamless international transactions.

Razorpay simplifies payments and business banking for seamless transactions and financial management.

GoDaddy, a global leader in domains and hosting, powers businesses with secure, user-friendly web solutions.

Trusted by millions, Tally automates accounting for accuracy, & compliance for businesses

Liability of shareholder for the losses of the company is limited to their contribution only.

A business of the Company will not affect if there is any change in the ownership of the company.

Public Company can be listed on stock exchange and raise funds by way of public issue.

Shares of a public company are freely transferable between its members and non-members.

The public company ensures stringent disclosure compliances. Financials of the company is in public domain.

Minimum 3 directors, Minimum 7 shareholders required and there is no limit on maximum shareholders of the company.

Upload the Required Documents & Information to our web portal

#1. Unlimited Members

One of the best advantage of public ltd company is that there is no limit on number of members in the company.

#2. Limited Liability

Despite having characteristic of unlimited members the liability of all the directors in Public limited company is limited to the extent of stake they hold in the company.

#3. More Transparency

Working of a public ltd company is more transparent because it separates its management from its ownership.

#4. Property Rights

A Public ltd Company can gain, posses, and enjoy its property in its own name. No shareholder can claim upon the property

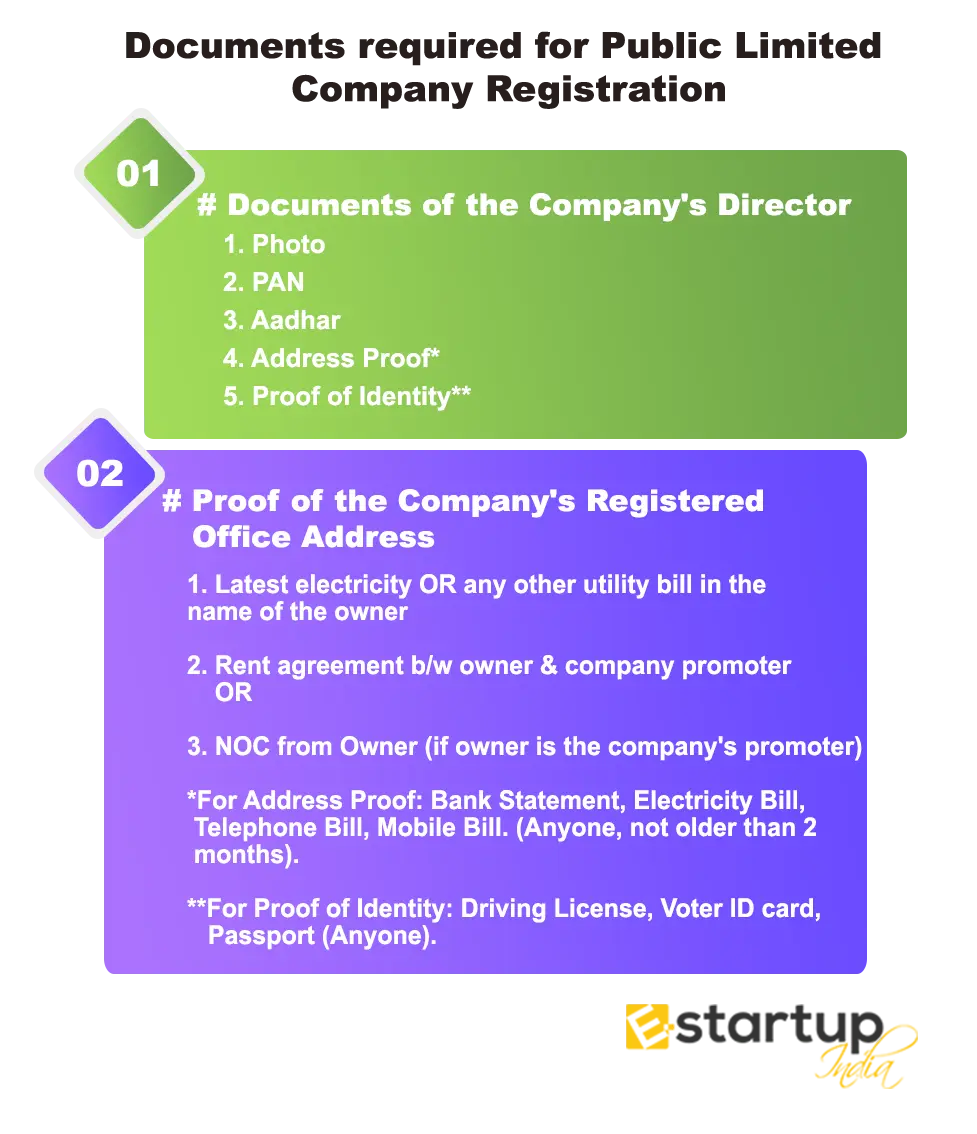

For company registrations, documents requirements are simple and handy. You must have the following documents under MCA:

1. Photo

2. PAN

3. Aadhar

4. Address Proof*

5. Proof of Identity**

1. Latest electricity OR any other utility bill in the name of the owner

2. Rent agreement b/w owner & company promoter

OR

3. NOC from Owner (if owner is the company's promoter)

*For Address Proof: Bank Statement, Electricity Bill, Telephone Bill, Mobile Bill. (Anyone, not older than 2 months).

**For Proof of Identity: Driving License, Voter ID card, Passport (Anyone).

Upload the Required Documents & Information to our web portal

Choose Package and Pay online with different payments modes available

We will apply for Digital Signature and Director Identification Number of proposed directors

Check for Company's Name availability, apply for Name Approval.

Prepare MOA, AOA and other necessary incorporation documents.

File incorporation documents & obtain Certificate of Incorporation, PAN &TAN.

#1. Raising funds is easy as Public Limited Company can issue the shares to the public. Thus, expansion and growth is rapid

#2. Death or departure of its shareholders or directors does not dissolve the company. Thus, business continuity is possible.

#3. Better corporate governance and accountability are promoted as Public Limited Companies are subjected to strict regulations and guidelines.

#4. The shares of a Public Limited Company can be easily sold or bought on the stock exchange, offering shareholders greater transferability and liquidity of their investment.

#5. Public Limited Companies can enjoy various tax benefits which are beneficial for both the company and its shareholders.

Listed and Unlisted Public Limited Companies have to follow a set of annual compliances in order to function legally. These are as follows:

Annual Compliances for Listed Public Limited Company

| No. | Compliance | Details | Form | Section | Deadline |

|---|---|---|---|---|---|

| 1 | Annual General Meeting | Conduct AGM in compliance with the Companies Act | Form MGT-15 | Section 121(1) of the Companies Act, 2013 | Within 30 days from the date of incorporation |

| 2 | Financial Statements | Prepare and file financial statements, including balance sheet, directors report, cash flow statement, auditors report and consolidated financial statement in XBRL format | Form AOC-4 | Section 137 of the Companies Act read with Rule 12(2) of the Companies (Accounts) Rules, 2014 | Within 30 days of holding the AGM |

| 3 | Annual Return | File information about directors and shareholders with the Registrar of Companies | Form MGT-7 | Section 92 of the Companies Act, 2013 read with Rule 11(1) of the Companies (Management and Administration) Rules 2014 | Within 60 days of the AGM |

| 4 | Financial and Directors Report | Adopt financial and directors reports | Form MGT-14 | Section 173 read along with Secretarial Standards 1 | Within 30 days from the board meeting |

| 5 | Income Tax Returns | File income tax returns with the Tax Department | Form ITR-6 | -- | On or before September 30th of the financial year |

| 6 | Secretarial Audit Repor | Submit Secretarial Audit Report along with Board Report if total paid-up capital is equal to or crosses Rs. 50 crore or annual turnover exceeds Rs. 250 crore | Form MR-3 | Section 204 of Companies Act, 2013 read with Rule 9 of The Companies (Appointment and Remuneration Personnel) Rules, 2014 | Before appointment or reappointment of The Secretarial Auditors |

| 7 | SEBI Compliance | Comply with all rules and regulations associated with SEBI, including Listing Regulations of 2015 | -- | Listing Regulations of 2015, SEBI | --- |

| S.No | Compliance | Particulars of Compliance | Form No. | Section and Rules | Due Dates |

|---|---|---|---|---|---|

| 1 | Board Meeting | Conduct at least four meetings a year and discuss matters related to the appointment or reappointment of auditors or related issues. | N/A | Section 173 of the Companies Act | At least 4 Board meeting in a year. |

| 2 | Appointment of Cost Auditor | Issue a letter of appointment to the Cost Auditor and inform the Central government of its appointment. | Form CRA-2 | Section 148(3) along with Rule 6(2) and Rule 6(3A) of the Companies (Cost Records and Audit) Rules,2014 | Original appointment within 30 days of the Board Meeting or 180 days of the financial year, whichever is earlier. Casual vacancy to be filled within 30 days of Board Meeting. |

| 3 | Return of Deposits (DPT) | File the Return of Deposit before the Registrar of Companies or ROC. | Form DPT-3 | Rule 16 of Companies (Acceptance or Deposit) Rules, 2014 | 30th June of every year. |

| 4 | Appointment of CEO or CFO or CS | Appoint a full-time or casual CEO or CS or CFO and file the necessary forms. | Form MGT- 14 and Form DIR-12 | Section 203 read with Rule 8 and 8A of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 | Within 30 days of the Annual General Meeting and, in the case of a casual vacancy, within 6 months. |

| 5 | Annual General Meeting | Conduct the Annual General Meeting for the declaration of dividends. | N/A | Section 96 of the Companies Act, 2013 | First Annual General Meeting to be held within 9 months of the end of the financial year. |

| 6 | Special Resolution | File the Special Resolution passed at the Annual General Meeting. | N/A | Section 117 of the Companies Act, 2013 to be read with Rule 24 of the Companies (Management and Administration) Rules, 2014 | Within 30 days of passing the resolution. |

| 7 | CSR Committee | Hold meetings and approve CSR activities. | N/A | Section 135 of the Companies Act, 2013 read with Companies (Corporate Social Responsibility Policy) Rules, 2014 and SS-1 | Hold at least four Board meetings with a gap of not less than 120 days between two Board meetings. |

| 8 | Director's Disclosure | Directors must disclose their financial interests in the company. | Form MBP-1 | Section 184(1) of the Companies Act, 2013 to be read along with Rule 9(1) of the Companies (Meetings of Board and its Powers) Rules,2014 | After their appointment in the first meeting. |

| S.No | Private Limited Company | Public Limited Company |

|---|---|---|

| 1 | Shares here can not be traded on the stock exchange. | Public Limited Companys shares can be exchanged on the stock market. |

| 2 | Maximum number of shareholders can be 200. | no limit to the number of shareholders |

| 3 | Private Limited Company Registration requires a minimum of two shareholders. | Public Limited Company Registration requires a minimum of seven shareholders. |

| 4 | Fewer Legal Requirements. | More Legal Requirements. |

| 5 | A minimum share capital of Rs. 1 Lakh is required. | A minimum share capital of Rs. 5 lakh is required. |

Serving business owners with an Average 4.8+ Google Rating.

Trusted by Axis bank to cater its clients all licensing & compliance needs.

Providing lending solutions for business needs with NeoGrowth.

Open Neo bank account worldwide & provides cross-border remittance solutions.

E-startupindia is a Proudly Member of Confederation of Indian Industry.The CII is a premier business association in India which works to create an environment.

E-Startup India is duly certified under GOI's Startup India scheme and is renowned for our tech-driven solutions for business & legal services requirements for MSMEs.

E-Startup India is a Google Partner, which implies we are rigorously involved in assisting SME businesses to market their presence in the digital world.

Private Limited Company | Public Limited Company | One Person Company | Limited Liability Partnership | Partnership Firm | Sole Proprietorship Firm | Section 8 Company Registration | USA Company Registration | UK Company Registration | UAE Company Registration | Singapore Company Registration | Company Registration Hong Kong | Import Export Code | IEC Modification | AD Code Registration | Spice Board Registration | US FDA Certification | ISO 9001 2015 | ISO 14001 EMS | ISO 22000 FSMS | ISO 27001 ISMS | ISO 50001 Energy Management | ISO 45001 | ISO Surveillance | ISO Certification | MSME Registration | FSSAI Registration | Shop Establishment Registration | Barcode Registration | Coffee Board Registration | Startup India Certificate | ZED Certification | Trademark | Trademark Objection Reply | Trademark Opposition | Trademark Hearing | Trademark Formality Check Fail | Website Development | Patent | Copyright | Design Registration | Business Name Suggestion | Logo Designing | Trademark Assignment Service | GST Registration | GST Modification | GST Cancellation | GST Return Filing | GST Invoice Software | UIN Registration | Income Tax Return | Income Tax Notice | Income Tax Refund | Income Tax Assessment | TDS Return Filing | Form 15CA / CB | Professional Tax Registration | 12A and 80G Registration | FCRA Registration | CSR Registration | Project Report | Pitch Deck | Seed Fund Startup India | Accounting for Ecommerce | Virtual cfo services in india | Bookkeeping & Accounting | Private limited Company Annual Compliance | Form INC-22A | Form 15CA / CB | Company Strike Off | Commencement of Business | Fssai annual return | Online CA Consultancy | Income Tax Return Filling | LLP Annual Compliances | Form DIR-3 KYC | Virtual Office for Company Registration | Dubai Company Registration | Business registration for USA | Business registration for UAE |