How to Change Mobile Number in GST Registration?

GST registration has indeed become a solution for all hindrances related to smooth business growth. Although every business having aggregate turnover beyond INR 40 Lakhs needs to get registered under GST, there are numerous benefits of voluntary GST registration procedure.

Sometimes, the already registered person needs to make changes or updates in his GST Registration certificate. Any change in the details mentioned in the GST certificate is known as GST modification. One can go for Amendment of GST Registration in case of shifting from composite to normal GST scheme, or if there are any errors in GST registration. One may also opt for GST modification if he wishes to make changes in:-

- Core fields

- Name of business

- Principal place of business,

- Addition/deletion of partners/directors

​Learn how to add multiple addresses in GST registration.

- Non-Core fields

​These include the details other than the core details, such as-

- E-mail ID of the authorized signatory

- Contact details of the authorized signatory

#1. Login to GST portal

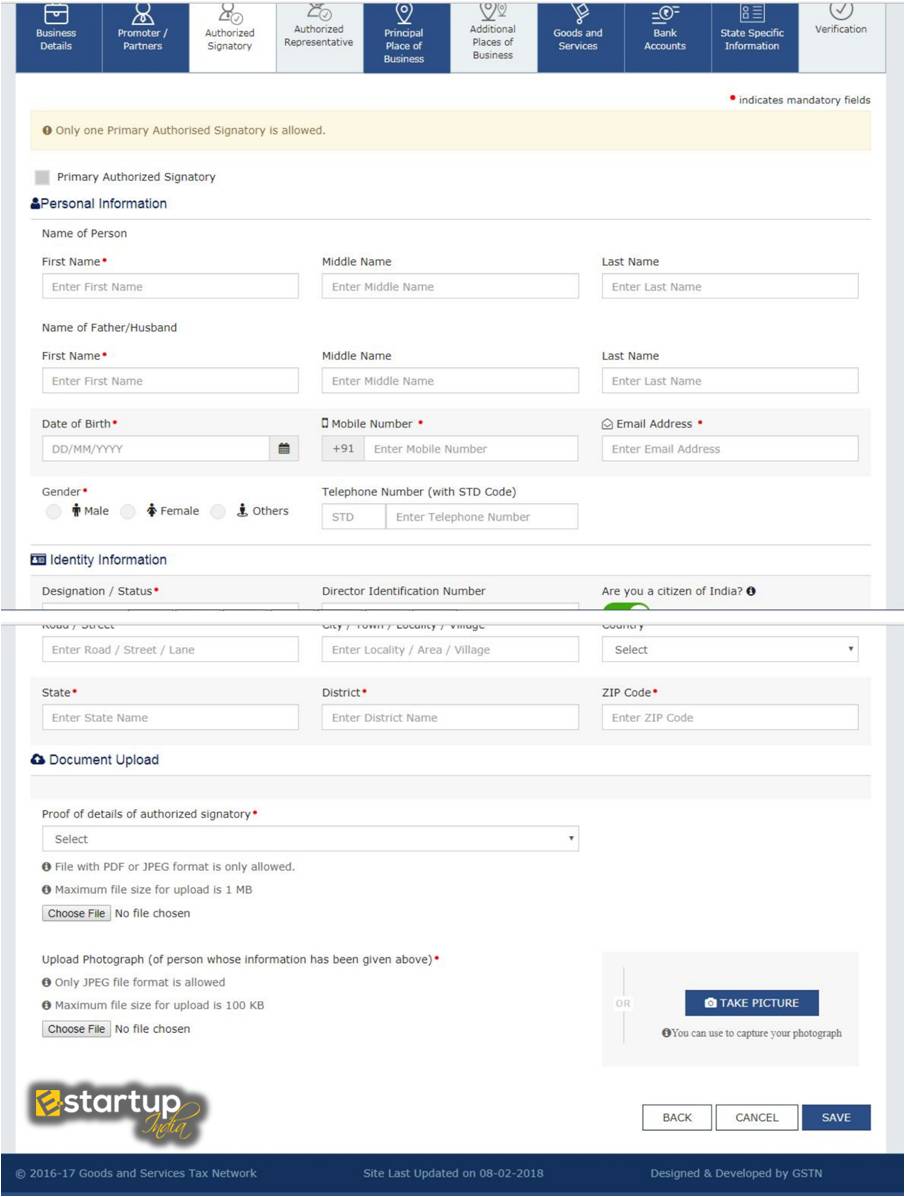

#2. Add New authorized signatory

Now you have to select the authorized signatory tab and click on Add New button given below.

#3. Disable the old authorized signatory

Now you have to select the old authorized signatory (proprietor).

Click on Edit - the Original authorized signatory (proprietor) and Unmark the Primary Authorized Signatory Box.

#4. Enable the new authorized signatory

Now select the new authorized signatory tab and there, check the Primary authorized signatory box. The new authorized signatory will be enabled.

Once the new authorized signatory is enabled, the previous Mobile No. & Email ID will be shown against the authorized signatory.

#5. Update Mobile No.

Against the new authorized signatory, you need to update the new Mobile No. and save.

#6. Validate with OTP

Once you save the new contact details, an OTP will be sent to the Mobile No. you’ve just saved. A pop-up will appear where you’ve to enter the OTP for validation of your phone number. Mobile No. will now be updated.

#7. Disable the new authorized signatory

Again you’ve to go to the new authorized signatory tab and unmark the primary authorized signatory box.

Now Delete the new authorized signatory.

#8. Enable the previous authorized signatory and submit the application

Once again select the Proprietor tab and check the Primary authorized signatory tab. The new mobile number shall now be seen. Click the SAVE and CONTINUE button and then submit the application.

Finally, the new mobile number shall now be updated on the GST registration certificate.

If you need any assistance regarding the entire process of GST registration or GST modification please feel free to contact our business advisor at 8881-069-069.

Now you can also Download E-Startup Mobile App and Never miss the latest updates relating to your business.

Instabill

Instabill

|

|